We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30. In this article we will look at what those investors think about General Electric Company (NYSE:GE).

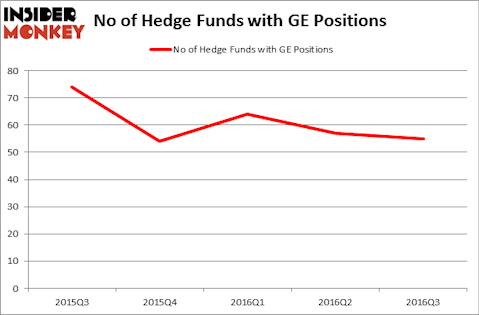

So, is General Electric Company (NYSE:GE) a buy, sell, or hold? Money managers are reducing their bets on the stock, as the number of long hedge fund bets fell by two lately. In this way, at the end of September, 55 funds tracked by Insider Monkey held shares of GE. At the end of this article we will also compare GE to other stocks including AT&T Inc. (NYSE:T), Wells Fargo & Co (NYSE:WFC), and China Mobile Ltd. (ADR) (NYSE:CHL) to get a better sense of its popularity.

Follow General Electric Co (NYSE:GE)

Follow General Electric Co (NYSE:GE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Sergey Kohl / Shutterstock.com

Keeping this in mind, let’s review the recent action encompassing General Electric Company (NYSE:GE).

What does the smart money think about General Electric Company (NYSE:GE)?

The number of funds tracked by Insider Monkey bullish on General Electric inched down by 4% to 55 during the third quarter. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Trian Partners, managed by Nelson Peltz, holds the largest position in General Electric Company (NYSE:GE). Trian Partners has a $2.1511 billion position in the stock, comprising 21% of its 13F portfolio. The second largest stake is held by Fisher Asset Management, led by Ken Fisher, holding a $931.7 million position; 1.7% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish encompass Warren Buffett’s Berkshire Hathaway, Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC and Phill Gross and Robert Atchinson’s Adage Capital Management.

Judging by the fact that General Electric Company (NYSE:GE) has witnessed bearish sentiment from hedge fund managers, it’s easy to see that there lies a certain “tier” of fund managers who were dropping their full holdings in the third quarter. At the top of the heap, John Burbank’s Passport Capital cut the biggest investment of all the hedgies monitored by Insider Monkey, valued at about $172.3 million in call options. Ken Griffin’s fund, Citadel Investment Group, also sold off its call options., about $102.1 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to General Electric Company (NYSE:GE). We will take a look at AT&T Inc. (NYSE:T), Wells Fargo & Co (NYSE:WFC), China Mobile Ltd. (ADR) (NYSE:CHL), and Verizon Communications Inc. (NYSE:VZ). This group of stocks’ market valuations are closest to GE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| T | 51 | 2546244 | -4 |

| WFC | 104 | 27422982 | 16 |

| CHL | 20 | 328304 | -3 |

| VZ | 54 | 3183595 | 2 |

As you can see these stocks had an average of 57 investors holding shares and the average amount invested in these stocks was $8.37 billion. That figure was $5.08 billion in GE’s case. Wells Fargo & Co (NYSE:WFC) is the most popular stock in this table with 104 funds holding shares. On the other hand China Mobile Ltd. (ADR) (NYSE:CHL) is the least popular one with only 20 bullish hedge fund positions. General Electric Company (NYSE:GE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Wells Fargo & Co (NYSE:WFC) might be a better candidate to consider a long position.