In this article we will analyze whether Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market by double digits annually.

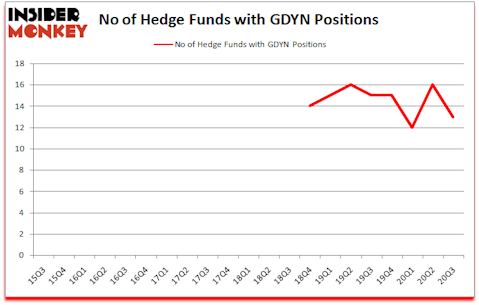

Is GDYN a good stock to buy now? Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) shareholders have witnessed a decrease in activity from the world’s largest hedge funds lately. Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) was in 13 hedge funds’ portfolios at the end of September. The all time high for this statistic is 16. There were 16 hedge funds in our database with GDYN holdings at the end of June. Our calculations also showed that GDYN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a multitude of methods stock traders use to value stocks. Two of the most useful methods are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the elite money managers can trounce their index-focused peers by a healthy margin (see the details here).

Michael Platt of BlueCrest Capital Mgmt.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 15 best blue chip stocks to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s take a look at the latest hedge fund action encompassing Grid Dynamics Holdings, Inc. (NASDAQ:GDYN).

Do Hedge Funds Think GDYN Is A Good Stock To Buy Now?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from the second quarter of 2020. By comparison, 15 hedge funds held shares or bullish call options in GDYN a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Israel Englander’s Millennium Management has the largest call position in Grid Dynamics Holdings, Inc. (NASDAQ:GDYN), worth close to $11.4 million, accounting for less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Alec Litowitz and Ross Laser of Magnetar Capital, with a $8.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish include Marc Lisker, Glenn Fuhrman and John Phelan’s MSDC Management, Richard Driehaus’s Driehaus Capital and Michael Platt and William Reeves’s BlueCrest Capital Mgmt.. In terms of the portfolio weights assigned to each position MSDC Management allocated the biggest weight to Grid Dynamics Holdings, Inc. (NASDAQ:GDYN), around 1.59% of its 13F portfolio. Crosslink Capital is also relatively very bullish on the stock, setting aside 0.43 percent of its 13F equity portfolio to GDYN.

Because Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) has witnessed a decline in interest from the smart money, logic holds that there is a sect of hedgies who were dropping their positions entirely by the end of the third quarter. At the top of the heap, John M. Angelo and Michael L. Gordon’s Angelo Gordon & Co dumped the largest position of all the hedgies monitored by Insider Monkey, worth an estimated $0.7 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund said goodbye to about $0.6 million worth. These moves are interesting, as aggregate hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) but similarly valued. These stocks are Marinus Pharmaceuticals Inc (NASDAQ:MRNS), Franklin Street Properties Corp. (NYSE:FSP), Designer Brands Inc. (NYSE:DBI), Eros STX Global Corporation (NYSE:ESGC), Bonanza Creek Energy Inc (NYSE:BCEI), Granite Point Mortgage Trust Inc. (NYSE:GPMT), and Kimball International Inc (NASDAQ:KBAL). This group of stocks’ market values match GDYN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MRNS | 13 | 148999 | -5 |

| FSP | 15 | 18823 | 2 |

| DBI | 13 | 48775 | -6 |

| ESGC | 5 | 21979 | -5 |

| BCEI | 16 | 63464 | 1 |

| GPMT | 13 | 20830 | 3 |

| KBAL | 19 | 68221 | 3 |

| Average | 13.4 | 55870 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.4 hedge funds with bullish positions and the average amount invested in these stocks was $56 million. That figure was $36 million in GDYN’s case. Kimball International Inc (NASDAQ:KBAL) is the most popular stock in this table. On the other hand Eros STX Global Corporation (NYSE:ESGC) is the least popular one with only 5 bullish hedge fund positions. Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for GDYN is 54.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 32.9% in 2020 through December 8th and still beat the market by 16.2 percentage points. A small number of hedge funds were also right about betting on GDYN as the stock returned 46.6% since the end of the third quarter (through 12/8) and outperformed the market by an even larger margin.

Follow Grid Dynamics Holdings Inc. (NASDAQ:GDYN)

Follow Grid Dynamics Holdings Inc. (NASDAQ:GDYN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.