We recently published a list of 10 Best Small-Cap Value Stocks to Buy Now. In this article, we are going to take a look at where Garrett Motion Inc. (NASDAQ:GTX) stands against other best small-cap value stocks to buy now.

Earlier on February 24, Robert Teeter of Silvercrest Asset Management shared his perspective on small-cap stocks and highlighted their link to economic conditions and sensitivity to financing activity. He noted that the Trump trade initially boosted small caps due to expectations of economic acceleration and lower interest rates, both of which are favorable for these companies. However, policy uncertainty and weaker-than-expected economic data have delayed their rally. Teeter believes that small caps will come into their own later in the year, but for now, they are facing a choppy market with significant rotation.

In advising clients, Teeter emphasized the importance of diversification within the S&P 500. He pointed out that the equal-weight benchmark has been performing well this year, and within the tech sector, the average tech stock is outperforming the tech sector as a whole. This suggests that investors are seeking diversification to protect themselves against policy risks. Teeter also highlighted healthcare as an interesting sector and noted that it has faced challenges with profit margins following the pandemic but now seems to have stabilized. He also discussed international markets and observed that they had outperformed US markets at the start of the year. He sees opportunities in these markets due to good valuations and the stabilization of the dollar, which reduces dollar strength and benefits non-US sectors.

Given Teetar’s sentiment, small-cap value stocks might be a good option right now due to their historically strong long-term performance and current undervaluation relative to large-cap stocks. According to Teeter, small caps are expected to recover later this year.

Methodology

We first used the Finviz stock screener to compile a list of small-cap value stocks that were trading between $300 million and $2 billion. We then picked 10 stocks with a forward P/E ratio under 15, that were the most popular among elite hedge funds and that analysts were bullish on. The stocks are ranked in ascending order of the number of hedge funds that have stakes in them, as of Q4 2024.

Note: All data was recorded on March 19.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

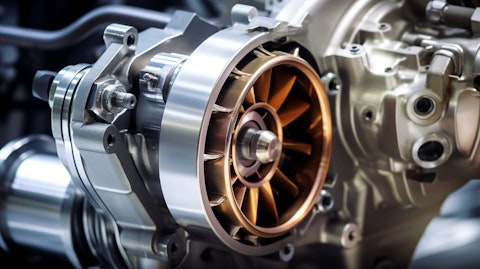

A close up of an engine piston with a commercial turbocharger attached.

Garrett Motion Inc. (NASDAQ:GTX)

Forward P/E Ratio as of March 19: 7.12

Market Capitalization as of March 19: $1.84 billion

Number of Hedge Fund Holders: 32

Garrett Motion Inc. (NASDAQ:GTX) designs and manufactures advanced turbocharging, air and fluid compression, and electric motor technologies for the automotive and industrial sectors. It provides innovative solutions for boosting internal combustion engines and develops cutting-edge technologies for electric and fuel cell applications.

The company’s Turbocharger segment achieved significant milestones in 2024. The company secured numerous light vehicle gasoline contracts across all geographical regions, which include notable expansions in the US and China, particularly with emerging Chinese manufacturers. These wins encompassed a range of powertrain technologies, which include plug-in hybrids and range extenders. Garrett Motion Inc. (NASDAQ:GTX) aims to maintain its business win rate of over 50% in the Turbocharger segment in 2025. It’s also investing in R&D with a focus on zero-emission technologies that complement the Turbocharger segment.

Garrett Motion Inc. (NASDAQ:GTX) made strides in the commercial vehicle sector as well and secured several contracts for natural gas on-highway applications in China, with launches scheduled as early as 2026. The segment broadened its portfolio by securing new awards for marine and backup power applications, which feature the company’s largest turbochargers, with production slated to commence in 2026.

McIntyre Partnerships believes that Garrett Motion Inc. (NASDAQ:GTX) is significantly undervalued due to market overreaction to BEV concerns. The company’s strong core business, BEV potential, and buybacks are being overlooked. Here’s what McIntyre Partnerships said in its Q4 2024 investor letter:

“Garrett Motion Inc. (NASDAQ:GTX) is a leading manufacturer in the moat-rich turbocharger (TB) market, with a global end-market and industry-leading margins. As TBs are not used in battery electric vehicles (BEVs), the market has concerns about GTX’s terminal value, which is suppressing its valuation. GTX trades ~5x my 2025 levered FCF with leverage at 2x EBITDA. Beyond its core business in TBs, GTX has a separate BEV growth story that is currently pre-revenue with high upfront costs, depressing GTX’s reported run-rate FCF. As a result, I believe GTX is even cheaper on owners’ earnings than the headline numbers suggest. Beyond its BEV investments, GTX has been using its FCF to buy back significant amounts of stock. Since 2022, GTX has retired almost one-third of its shares outstanding. If either BEV penetration is less bad than feared or GTX has success in its BEV investments, I believe GTX shares are significantly undervalued.

Before I dig into numbers, I want to revisit GTX’s TB business, which I believe has a deep moat and is highly predictable. TBs are a high-tech, mission-critical component of a car’s engine. The TB market is a duopoly between BWA and GTX. While there are also smaller Asian competitors, GTX and BWA enjoy significant engineering and R&D advantages over their peers, which creates a moat and allows GTX to earn among the highest margins and lowest annual price downs of any publicly traded auto supplier. TBs are essentially mini-jet engines that take the exhaust fumes and push that air back into the engine, increasing power and fuel efficiency. TBs are highly sophisticated devices – the TB’s turbine spins at up to 150,000 RPMs, yet the distance between the spinning turbine and the wall of the TB can be as small as a seventh the width of a human hair. GTX’s years of R&D allow them to deliver products that competitors cannot match. As a testament to this, Bosch and Mahle, two of the largest auto suppliers in the world, launched a TB joint venture in the late 2000s with the explicit blessing and support of GTX’s customers, the auto OEMs. A scaled competitor teaming up with your customers to break your duopoly is a business nightmare, yet after a decade, Bosch-Mahle gave up and exited the space. They could not match GTX’s products. Finally, the TB is a critical component of an engine, which is, in turn, the most important component of a car. Engines are designed years in advance, and once a product is designed into an engine, it is virtually impossible to design out. Once Mercedes designs a Garrett TB into an AMG engine, GTX has an almost guaranteed 100% renewal product with a multi-year life cycle. GTX’s backlog is exceptionally sticky and 90% booked 3+ years out. While BEV is a wild card, GTX has visibility on its core operations for years…” (Click here to read the full text)

Overall, GTX ranks 3rd on our list of best small-cap value stocks to buy now. While we acknowledge the growth potential of GTX, our conviction lies in the belief that AI stocks hold great promise for delivering high returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than GTX but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires

Disclosure: None. This article is originally published at Insider Monkey.