We recently published a list of 10 Best Single Digit Stocks To Buy Now. In this article, we are going to take a look at where Garrett Motion Inc. (NASDAQ:GTX) stands against other best single digit stocks to buy now.

The US markets had a blockbuster 2024, led by a strong show by the technology sector. The broader market grew by over 23% during the year after rising 24% in 2023. Two consecutive years of over 20% gains marked the market’s best performance in nearly three decades.

READ ALSO: 12 Best Long-Term Penny Stocks to Buy According to Hedge Funds and 10 Best Penny Stocks to Buy for 2025.

Stocks have benefited from a resilient American economy that steered clear of recession. Waning inflation and interest rate cuts also bolstered investor sentiment throughout last year. Research analysts anticipate continued growth in 2025 amid strong economic data and anticipation of a business-friendly Trump administration.

In a note on December 30, Wedbush Securities analyst, Dan Ives, said that he expects tech stocks to surge 25% this year with the incoming Trump administration focusing on slashing unnecessary regulations.

Todd Rosenbluth, the head of research at VettaFi, believes 2025 could be the year for small-cap stocks with solid underlying fundamentals. He expects ETFs specializing in small-caps to make gains as investors broaden their market exposure as interest rates ease.

Rosenbluth shared the following remarks while talking to CNBC in late November.

“Small caps are going to become more in favor in 2025. They started to perk up since the election and heading into the election as interest rates have been coming down.”

Fundstrat’s Tom Lee also shares similar sentiments. In an interview in November, he said that small-cap stocks could soar in the coming years under the new administration, driving monster returns.

“I do think there’s still a lot of upside. So I think small-caps could, over the next couple of years, outperform by more than 100%.”

On the other hand, some Wall Street analysts are cautious about the new year and have warned of potential downsides, with the incoming administration promising new tariffs. Following his election victory, President-elect Trump vowed to impose steep tariffs on imports from Canada, China, and Mexico, which could increase costs for manufacturers. Ongoing geopolitical tensions in different parts of the world could also hurt the stock market.

Jurrien Timmer, Director of Global Macro for Fidelity Management & Research Company wrote the following in a note on December 18.

“Personally, I am bullish on stocks for 2025, though with valuations high and the bull market maturing, I don’t think investors should expect quite such spectacular returns next year as we have seen this past year. And I think there are important risks from inflation, and the market’s concentration, to be aware of.”

Methodology

For this article, we sifted through screeners to get a list of stocks priced greater than $1 and less than $10, with a low forward price-earnings ratio (<15) and institutional ownership of over 70%. From there, we selected the 10 stocks with the highest number of hedge fund investors, based on Insider Monkey’s database of over 900 prominent hedge funds as of Q3 2024.

The 10 best single digit stocks to buy now have been ranked in ascending order based on the number of hedge funds holding stakes in them. Where two or more stocks were tied on hedge fund sentiment, we used a higher market cap as a tiebreaker between them. Please note that all data is as of the close of day on Friday, December 27, 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

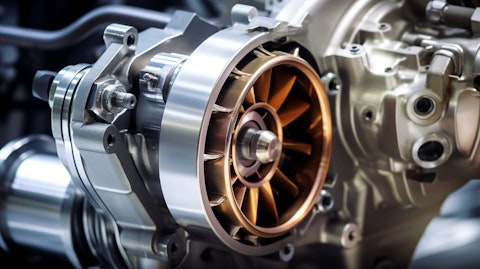

A close up of an engine piston with a commercial turbocharger attached.

Garrett Motion Inc. (NASDAQ:GTX)

Share Price as of December 27: $8.96

Number of Hedge Fund Holders: 34

Garrett Motion Inc. (NASDAQ:GTX) is an automotive technology company based in Switzerland. It specializes in turbocharging and electric boosting technologies for light and commercial vehicle OEMs and the aftermarket.

The company has numerous R&D centers, engineering facilities, and factories worldwide. It also boasts a large distribution network. Moreover, GTX maintains strong partnerships with global and Chinese automakers through its diverse range of turbocharging solutions for gasoline, diesel, natural gas, hybrid, and zero-emission battery electric vehicles.

In September 2024, Garrett Motion Inc. (NASDAQ:GTX) announced that it had signed a letter of intent with SinoTruk to enhance cooperation on electric commercial vehicles. Both companies aim to jointly co-develop a leading next-generation electric powertrain and mass-produce e-trucks equipped with this next-gen E-powertrain by 2027. This alliance is expected to expand the adoption of zero-emission technologies in China’s commercial vehicle market.

During its recent Q3 2024 earnings call on October 24, Garrett Motion Inc. (NASDAQ:GTX) announced robust financial results despite a challenging environment in the market. Net sales were posted at $826 million, down 14% from last year, due to industry softness and competitive pressures on global OEMs. However, it delivered a strong adjusted EBITDA margin of 17.4%, which was a notable year-over-year improvement driven by the successful implementation of sustainable fixed-cost actions and investments in new technologies.

Garrett Motion Inc. (NASDAQ:GTX) is seeing accelerating momentum in zero-emission vehicle technologies; it directed more than half of all its R&D spending in 2024 toward it. This has resulted in a general bullish sentiment among both Wall Street analysts and investors for the stock. According to Insider Monkey’s database for Q3 2024, 34 hedge funds had investments in the company, up from 32 at the end of the second quarter. It is one of the best single digit stocks to buy now.

Overall, GTX ranks 5th on our list of best single digit stocks to buy now. While we acknowledge the potential of human capital technology companies, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than GTX but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock

Disclosure: None. This article is originally published at Insider Monkey.