Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow nearly 817 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Fulcrum Therapeutics, Inc. (NASDAQ:FULC), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

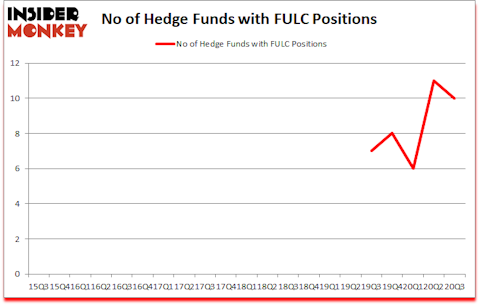

Is FULC a good stock to buy now? Fulcrum Therapeutics, Inc. (NASDAQ:FULC) shareholders have witnessed a decrease in enthusiasm from smart money lately. Fulcrum Therapeutics, Inc. (NASDAQ:FULC) was in 10 hedge funds’ portfolios at the end of September. The all time high for this statistics is 11. There were 11 hedge funds in our database with FULC positions at the end of the second quarter. Our calculations also showed that FULC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most stock holders, hedge funds are assumed to be worthless, old financial tools of the past. While there are over 8000 funds with their doors open today, Our experts hone in on the moguls of this club, around 850 funds. Most estimates calculate that this group of people shepherd the lion’s share of all hedge funds’ total capital, and by paying attention to their top investments, Insider Monkey has figured out various investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

Oleg Nodelman of EcoR1 Capital

With all of this in mind let’s review the latest hedge fund action encompassing Fulcrum Therapeutics, Inc. (NASDAQ:FULC).

Do Hedge Funds Think FULC Is A Good Stock To Buy Now?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FULC over the last 21 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Point72 Asset Management held the most valuable stake in Fulcrum Therapeutics, Inc. (NASDAQ:FULC), which was worth $12 million at the end of the third quarter. On the second spot was Casdin Capital which amassed $11.4 million worth of shares. Opaleye Management, Harvard Management Co, and Acuta Capital Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Burrage Capital Management allocated the biggest weight to Fulcrum Therapeutics, Inc. (NASDAQ:FULC), around 1.83% of its 13F portfolio. Acuta Capital Partners is also relatively very bullish on the stock, earmarking 0.82 percent of its 13F equity portfolio to FULC.

Due to the fact that Fulcrum Therapeutics, Inc. (NASDAQ:FULC) has experienced a decline in interest from the smart money, logic holds that there is a sect of fund managers who were dropping their full holdings in the third quarter. Interestingly, Oleg Nodelman’s EcoR1 Capital cut the biggest stake of all the hedgies monitored by Insider Monkey, valued at about $16.1 million in stock. Joseph Edelman’s fund, Perceptive Advisors, also dropped its stock, about $15.8 million worth. These transactions are important to note, as total hedge fund interest dropped by 1 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Fulcrum Therapeutics, Inc. (NASDAQ:FULC) but similarly valued. These stocks are Houghton Mifflin Harcourt Co (NASDAQ:HMHC), P.A.M. Transportation Services, Inc. (NASDAQ:PTSI), Transcat, Inc. (NASDAQ:TRNS), Accuray Incorporated (NASDAQ:ARAY), Home Bancorp, Inc. (NASDAQ:HBCP), National CineMedia, Inc. (NASDAQ:NCMI), and Kaleyra, Inc. (NASDAQ:KLR). This group of stocks’ market values match FULC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HMHC | 17 | 58828 | -3 |

| PTSI | 1 | 13714 | 0 |

| TRNS | 7 | 48914 | -2 |

| ARAY | 16 | 40601 | 2 |

| HBCP | 2 | 5164 | -1 |

| NCMI | 12 | 22255 | -6 |

| KLR | 13 | 27596 | 0 |

| Average | 9.7 | 31010 | -1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.7 hedge funds with bullish positions and the average amount invested in these stocks was $31 million. That figure was $40 million in FULC’s case. Houghton Mifflin Harcourt Co (NASDAQ:HMHC) is the most popular stock in this table. On the other hand P.A.M. Transportation Services, Inc. (NASDAQ:PTSI) is the least popular one with only 1 bullish hedge fund positions. Fulcrum Therapeutics, Inc. (NASDAQ:FULC) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for FULC is 59.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 32.9% in 2020 through December 8th and still beat the market by 16.2 percentage points. Hedge funds were also right about betting on FULC as the stock returned 66.2% since the end of Q3 (through 12/8) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Fulcrum Therapeutics Inc. (NASDAQ:FULC)

Follow Fulcrum Therapeutics Inc. (NASDAQ:FULC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.