The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31st. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Freshpet Inc (NASDAQ:FRPT).

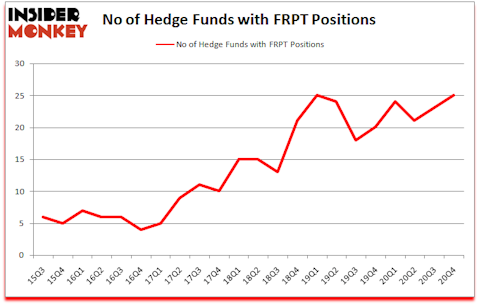

Is FRPT stock a buy? Freshpet Inc (NASDAQ:FRPT) was in 25 hedge funds’ portfolios at the end of December. The all time high for this statistic is 25. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. FRPT has experienced an increase in support from the world’s most elite money managers lately. There were 23 hedge funds in our database with FRPT positions at the end of the third quarter. Our calculations also showed that FRPT isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Kris Jenner of Rock Springs Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, auto parts business is a recession resistant business, so we are taking a closer look at this discount auto parts stock that is growing at a 196% annualized rate. We go through lists like the 15 best micro-cap stocks to buy now to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to take a glance at the recent hedge fund action regarding Freshpet Inc (NASDAQ:FRPT).

Do Hedge Funds Think FRPT Is A Good Stock To Buy Now?

At the end of the fourth quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from the third quarter of 2020. Below, you can check out the change in hedge fund sentiment towards FRPT over the last 22 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Rock Springs Capital Management, managed by Kris Jenner, Gordon Bussard, Graham McPhail, holds the most valuable position in Freshpet Inc (NASDAQ:FRPT). Rock Springs Capital Management has a $71.9 million position in the stock, comprising 1.5% of its 13F portfolio. The second most bullish fund manager is Driehaus Capital, managed by Richard Driehaus, which holds a $29 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions contain Ken Fisher’s Fisher Asset Management, Li Ran’s Half Sky Capital and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Half Sky Capital allocated the biggest weight to Freshpet Inc (NASDAQ:FRPT), around 6.1% of its 13F portfolio. Aubrey Capital Management is also relatively very bullish on the stock, setting aside 1.7 percent of its 13F equity portfolio to FRPT.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Half Sky Capital, managed by Li Ran, created the biggest position in Freshpet Inc (NASDAQ:FRPT). Half Sky Capital had $17 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $1.9 million position during the quarter. The other funds with brand new FRPT positions are Peter Muller’s PDT Partners, Michael Gelband’s ExodusPoint Capital, and Jinghua Yan’s TwinBeech Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Freshpet Inc (NASDAQ:FRPT) but similarly valued. These stocks are National Instruments Corporation (NASDAQ:NATI), First American Financial Corp (NYSE:FAF), Berkeley Lights, Inc. (NASDAQ:BLI), Western Midstream Partners, LP (NYSE:WES), FLIR Systems, Inc. (NASDAQ:FLIR), BWX Technologies Inc (NYSE:BWXT), and JFrog Ltd. (NASDAQ:FROG). This group of stocks’ market caps match FRPT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NATI | 18 | 209207 | -4 |

| FAF | 39 | 750439 | -3 |

| BLI | 16 | 226964 | 6 |

| WES | 10 | 107334 | 0 |

| FLIR | 28 | 418833 | 3 |

| BWXT | 19 | 144151 | -2 |

| FROG | 16 | 324292 | -6 |

| Average | 20.9 | 311603 | -0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.9 hedge funds with bullish positions and the average amount invested in these stocks was $312 million. That figure was $205 million in FRPT’s case. First American Financial Corp (NYSE:FAF) is the most popular stock in this table. On the other hand Western Midstream Partners, LP (NYSE:WES) is the least popular one with only 10 bullish hedge fund positions. Freshpet Inc (NASDAQ:FRPT) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for FRPT is 62.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. Hedge funds were also right about betting on FRPT as the stock returned 21.1% since the end of Q4 (through 4/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Freshpet Inc. (NASDAQ:FRPT)

Follow Freshpet Inc. (NASDAQ:FRPT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.