Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first quarter, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first quarter still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Foot Locker, Inc. (NYSE:FL) changed recently.

Hedge fund interest in Foot Locker, Inc. (NYSE:FL) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare FL to other stocks including KAR Auction Services Inc (NYSE:KAR), YY Inc (NASDAQ:YY), and WABCO Holdings Inc. (NYSE:WBC) to get a better sense of its popularity.

To most traders, hedge funds are perceived as underperforming, outdated investment vehicles of yesteryear. While there are over 8000 funds in operation today, We look at the crème de la crème of this club, about 750 funds. It is estimated that this group of investors direct the majority of the hedge fund industry’s total asset base, and by watching their top investments, Insider Monkey has spotted numerous investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s review the new hedge fund action encompassing Foot Locker, Inc. (NYSE:FL).

How are hedge funds trading Foot Locker, Inc. (NYSE:FL)?

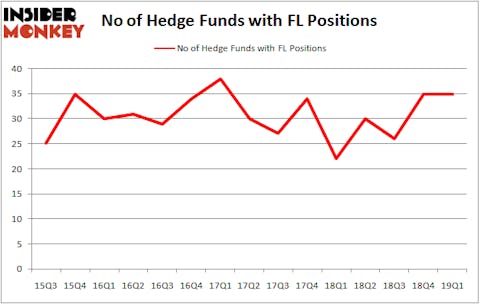

At Q1’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FL over the last 15 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Foot Locker, Inc. (NYSE:FL) was held by AQR Capital Management, which reported holding $384.6 million worth of stock at the end of March. It was followed by Two Sigma Advisors with a $104.3 million position. Other investors bullish on the company included GLG Partners, Millennium Management, and Citadel Investment Group.

Since Foot Locker, Inc. (NYSE:FL) has witnessed falling interest from the aggregate hedge fund industry, we can see that there was a specific group of fund managers that elected to cut their positions entirely by the end of the third quarter. It’s worth mentioning that Dmitry Balyasny’s Balyasny Asset Management sold off the largest stake of all the hedgies watched by Insider Monkey, comprising close to $33.2 million in stock. Lee Ainslie’s fund, Maverick Capital, also dropped its stock, about $32.4 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Foot Locker, Inc. (NYSE:FL). We will take a look at KAR Auction Services Inc (NYSE:KAR), YY Inc (NASDAQ:YY), WABCO Holdings Inc. (NYSE:WBC), and World Wrestling Entertainment, Inc. (NYSE:WWE). All of these stocks’ market caps resemble FL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KAR | 42 | 1234048 | 8 |

| YY | 20 | 129700 | -4 |

| WBC | 36 | 801213 | 22 |

| WWE | 47 | 1022250 | 13 |

| Average | 36.25 | 796803 | 9.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.25 hedge funds with bullish positions and the average amount invested in these stocks was $797 million. That figure was $956 million in FL’s case. World Wrestling Entertainment, Inc. (NYSE:WWE) is the most popular stock in this table. On the other hand YY Inc (NASDAQ:YY) is the least popular one with only 20 bullish hedge fund positions. Foot Locker, Inc. (NYSE:FL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately FL wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); FL investors were disappointed as the stock returned -32.3% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.