Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Foot Locker, Inc. (NYSE:FL).

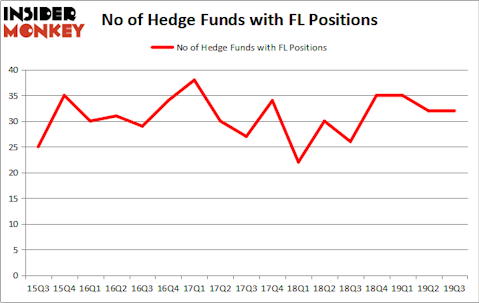

Foot Locker, Inc. (NYSE:FL) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 32 hedge funds’ portfolios at the end of the third quarter of 2019. At the end of this article we will also compare FL to other stocks including Avnet, Inc. (NASDAQ:AVT), The Wendy’s Company (NASDAQ:WEN), and Bilibili Inc. (NASDAQ:BILI) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most market participants, hedge funds are viewed as underperforming, old financial tools of yesteryear. While there are more than 8000 funds trading at the moment, Our researchers hone in on the bigwigs of this group, around 750 funds. These hedge fund managers have their hands on the majority of all hedge funds’ total asset base, and by following their highest performing picks, Insider Monkey has determined numerous investment strategies that have historically defeated the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Ray Dalio of Bridgewater Associates

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to review the latest hedge fund action regarding Foot Locker, Inc. (NYSE:FL).

Hedge fund activity in Foot Locker, Inc. (NYSE:FL)

At the end of the third quarter, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 26 hedge funds with a bullish position in FL a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in Foot Locker, Inc. (NYSE:FL), which was worth $191.2 million at the end of the third quarter. On the second spot was Arrowstreet Capital which amassed $85.7 million worth of shares. Bridgewater Associates, Balyasny Asset Management, and Kettle Hill Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Kettle Hill Capital Management allocated the biggest weight to Foot Locker, Inc. (NYSE:FL), around 6.92% of its portfolio. Armistice Capital is also relatively very bullish on the stock, setting aside 1.76 percent of its 13F equity portfolio to FL.

Due to the fact that Foot Locker, Inc. (NYSE:FL) has experienced declining sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few money managers that decided to sell off their entire stakes last quarter. Intriguingly, Robert Pohly’s Samlyn Capital dumped the biggest position of the “upper crust” of funds followed by Insider Monkey, valued at an estimated $14.8 million in call options. Anthony Joseph Vaccarino’s fund, North Fourth Asset Management, also dumped its call options, about $12.6 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Foot Locker, Inc. (NYSE:FL) but similarly valued. These stocks are Avnet, Inc. (NASDAQ:AVT), The Wendy’s Company (NASDAQ:WEN), Bilibili Inc. (NASDAQ:BILI), and Grupo Aeroportuario del Sureste (NYSE:ASR). All of these stocks’ market caps are similar to FL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVT | 28 | 678095 | 1 |

| WEN | 34 | 892985 | 10 |

| BILI | 18 | 383762 | -5 |

| ASR | 4 | 38248 | -3 |

| Average | 21 | 498273 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $498 million. That figure was $546 million in FL’s case. The Wendy’s Company (NASDAQ:WEN) is the most popular stock in this table. On the other hand Grupo Aeroportuario del Sureste (NYSE:ASR) is the least popular one with only 4 bullish hedge fund positions. Foot Locker, Inc. (NYSE:FL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately FL wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FL were disappointed as the stock returned -6.4% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.