Is Foot Locker, Inc. (NYSE:FL) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

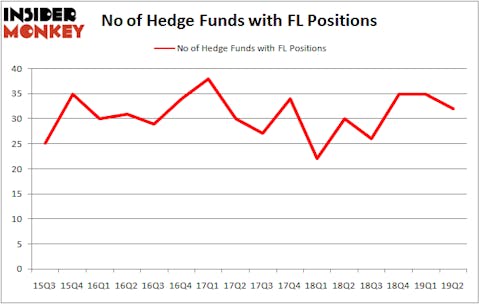

Foot Locker, Inc. (NYSE:FL) was in 32 hedge funds’ portfolios at the end of June. FL shareholders have witnessed a decrease in activity from the world’s largest hedge funds lately. There were 35 hedge funds in our database with FL holdings at the end of the previous quarter. Our calculations also showed that FL isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the key hedge fund action regarding Foot Locker, Inc. (NYSE:FL).

Hedge fund activity in Foot Locker, Inc. (NYSE:FL)

At Q2’s end, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. By comparison, 30 hedge funds held shares or bullish call options in FL a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in Foot Locker, Inc. (NYSE:FL), which was worth $304.8 million at the end of the second quarter. On the second spot was Samlyn Capital which amassed $66.6 million worth of shares. Moreover, Millennium Management, Arrowstreet Capital, and Bridgewater Associates were also bullish on Foot Locker, Inc. (NYSE:FL), allocating a large percentage of their portfolios to this stock.

Because Foot Locker, Inc. (NYSE:FL) has witnessed a decline in interest from the smart money, logic holds that there is a sect of hedgies that elected to cut their full holdings last quarter. At the top of the heap, Gregg Moskowitz’s Interval Partners sold off the biggest stake of all the hedgies watched by Insider Monkey, totaling close to $38.7 million in stock, and Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital was right behind this move, as the fund cut about $25.1 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Foot Locker, Inc. (NYSE:FL). These stocks are Six Flags Entertainment Corp (NYSE:SIX), The Boston Beer Company Inc (NYSE:SAM), New Jersey Resources Corp (NYSE:NJR), and Generac Holdings Inc. (NYSE:GNRC). All of these stocks’ market caps match FL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIX | 30 | 741613 | 0 |

| SAM | 23 | 591137 | 1 |

| NJR | 12 | 78095 | 1 |

| GNRC | 25 | 229086 | 8 |

| Average | 22.5 | 409983 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $410 million. That figure was $593 million in FL’s case. Six Flags Entertainment Corp (NYSE:SIX) is the most popular stock in this table. On the other hand New Jersey Resources Corp (NYSE:NJR) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Foot Locker, Inc. (NYSE:FL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on FL, though not to the same extent, as the stock returned 3.9% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.