Last year’s fourth quarter was a rough one for investors and many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 37.4% in 2019 (through the end of November) and outperformed the S&P 500 ETF by 9.9 percentage points. We are done processing the latest 13F filings and in this article, we will study how hedge fund sentiment towards FNCB Bancorp Inc. (NASDAQ:FNCB) changed during the third quarter.

FNCB Bancorp Inc. (NASDAQ:FNCB) investors should pay attention to an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that FNCB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are seen as slow, old financial vehicles of the past. While there are over 8000 funds trading at the moment, Our researchers choose to focus on the top tier of this group, approximately 750 funds. These money managers preside over the majority of all hedge funds’ total capital, and by shadowing their best picks, Insider Monkey has come up with several investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update.

Israel Englander of Millennium Management

We leave no stone unturned when looking for the next great investment idea. For example, Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now we’re going to analyze the recent hedge fund action regarding FNCB Bancorp Inc. (NASDAQ:FNCB).

What does smart money think about FNCB Bancorp Inc. (NASDAQ:FNCB)?

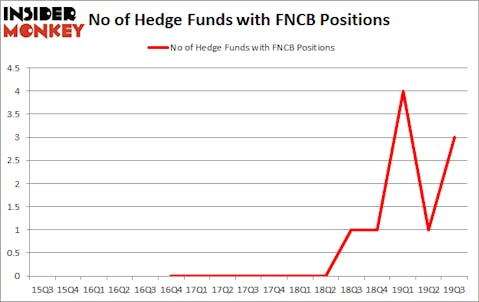

At the end of the third quarter, a total of 3 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 200% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FNCB over the last 17 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of FNCB Bancorp Inc. (NASDAQ:FNCB), with a stake worth $0.3 million reported as of the end of September. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $0.1 million. Royce & Associates was also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position, Royce & Associates allocated the biggest weight to FNCB Bancorp Inc. (NASDAQ:FNCB), around 0.0003% of its 13F portfolio. Renaissance Technologies is also relatively very bullish on the stock, setting aside 0.0003 percent of its 13F equity portfolio to FNCB.

Consequently, specific money managers have been driving this bullishness. Millennium Management, managed by Israel Englander, created the biggest position in FNCB Bancorp Inc. (NASDAQ:FNCB). Millennium Management had $0.1 million invested in the company at the end of the quarter. Chuck Royce’s Royce & Associates also initiated a $0 million position during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as FNCB Bancorp Inc. (NASDAQ:FNCB) but similarly valued. We will take a look at CannTrust Holdings Inc. (NYSE:CTST), X4 Pharmaceuticals, Inc. (NASDAQ:XFOR), Medallion Financial Corp. (NASDAQ:MFIN), and MVC Capital, Inc. (NYSE:MVC). This group of stocks’ market values matches FNCB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTST | 5 | 715 | -7 |

| XFOR | 6 | 46291 | 0 |

| MFIN | 7 | 3771 | 1 |

| MVC | 9 | 46000 | 0 |

| Average | 6.75 | 24194 | -1.5 |

View the table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $0 million in FNCB’s case. MVC Capital, Inc. (NYSE:MVC) is the most popular stock in this table. On the other hand, CannTrust Holdings Inc. (NYSE:CTST) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks FNCB Bancorp Inc. (NASDAQ:FNCB) is even less popular than CTST. Hedge funds dodged a bullet by taking a bearish stance towards FNCB. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately, FNCB wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); FNCB investors were disappointed as the stock returned 4.6% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large-cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.