Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of FMC Corp (NYSE:FMC).

FMC Corp (NYSE:FMC) investors should pay attention to a decrease in activity from the world’s largest hedge funds lately. At the end of this article we will also compare FMC to other stocks including Liberty Broadband Corp (NASDAQ:LBRDA), Spirit Realty Capital Inc (NYSE:SRC), and Companhia de Saneamento Basico (ADR) (NYSE:SBS) to get a better sense of its popularity.

Follow Fmc Corp (NYSE:FMC)

Follow Fmc Corp (NYSE:FMC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

SUWIT NGAOKAEW/Shutterstock.com

Now, we’re going to take a look at the fresh action surrounding FMC Corp (NYSE:FMC).

How are hedge funds trading FMC Corp (NYSE:FMC)?

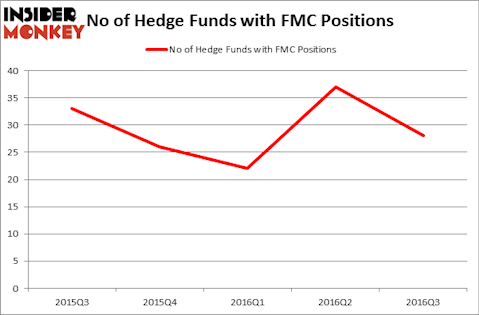

At Q3’s end, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of -24% from the second quarter of 2016. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Glenview Capital, managed by Larry Robbins, holds the biggest position in FMC Corp (NYSE:FMC). Glenview Capital has a $503.5 million position in the stock, comprising 3.6% of its 13F portfolio. Sitting at the No. 2 spot is OZ Management, led by Daniel S. Och, holding a $146.1 million position; 0.8% of its 13F portfolio is allocated to the company. Remaining professional money managers that hold long positions encompass David Fear’s Thunderbird Partners, Jeffrey Bronchick’s Cove Street Capital and Craig C. Albert’s Sheffield Asset Management.

Judging by the fact that FMC Corp (NYSE:FMC) has witnessed a decline in interest from the smart money, it’s safe to say that there lies a certain “tier” of hedge funds who were dropping their positions entirely in the third quarter. Intriguingly, Steve Cohen’s Point72 Asia (Singapore) said goodbye to the largest position of the 700 funds followed by Insider Monkey, valued at close to $19.4 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund said goodbye to about $18.9 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 9 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to FMC Corp (NYSE:FMC). We will take a look at Liberty Broadband Corp (NASDAQ:LBRDA), Spirit Realty Capital Inc (NYSE:SRC), Companhia de Saneamento Basico (ADR) (NYSE:SBS), and Trimble Navigation Limited (NASDAQ:TRMB). This group of stocks’ market valuations are similar to FMC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LBRDA | 27 | 399996 | 1 |

| SRC | 17 | 340235 | -3 |

| SBS | 16 | 206265 | 0 |

| TRMB | 19 | 531380 | 1 |

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $369 million. That figure was $1.01 billion in FMC’s case. Liberty Broadband Corp (NASDAQ:LBRDA) is the most popular stock in this table. On the other hand Companhia de Saneamento Basico (ADR) (NYSE:SBS) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks FMC Corp (NYSE:FMC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.