The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Flex Ltd. (NASDAQ:FLEX).

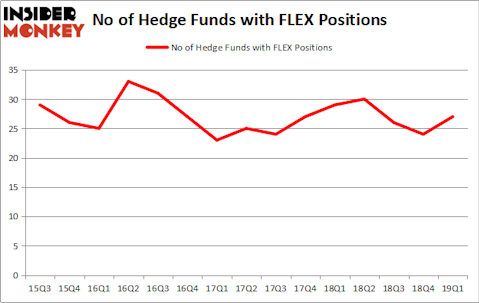

Is Flex Ltd. (NASDAQ:FLEX) an excellent stock to buy now? Hedge funds are betting on the stock. The number of bullish hedge fund positions inched up by 3 lately. Our calculations also showed that FLEX isn’t among the 30 most popular stocks among hedge funds. FLEX was in 27 hedge funds’ portfolios at the end of March. There were 24 hedge funds in our database with FLEX positions at the end of the previous quarter.

In the 21st century investor’s toolkit there are a multitude of methods investors put to use to assess publicly traded companies. Some of the most underrated methods are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can trounce the S&P 500 by a solid amount (see the details here).

We’re going to analyze the recent hedge fund action surrounding Flex Ltd. (NASDAQ:FLEX).

What does the smart money think about Flex Ltd. (NASDAQ:FLEX)?

Heading into the second quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the fourth quarter of 2018. By comparison, 29 hedge funds held shares or bullish call options in FLEX a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Flex Ltd. (NASDAQ:FLEX) was held by Glenview Capital, which reported holding $205.4 million worth of stock at the end of March. It was followed by D E Shaw with a $161.1 million position. Other investors bullish on the company included Citadel Investment Group, Pzena Investment Management, and AQR Capital Management.

As one would reasonably expect, some big names have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the biggest position in Flex Ltd. (NASDAQ:FLEX). Arrowstreet Capital had $16.2 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $8.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Ernest Chow and Jonathan Howe’s Sensato Capital Management, and Ravee Mehta’s Nishkama Capital.

Let’s now review hedge fund activity in other stocks similar to Flex Ltd. (NASDAQ:FLEX). These stocks are Companhia Energetica de Minas Gerais (NYSE:CIG), Skechers USA Inc (NYSE:SKX), Primerica, Inc. (NYSE:PRI), and Alteryx, Inc. (NYSE:AYX). This group of stocks’ market values resemble FLEX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CIG | 9 | 27706 | 2 |

| SKX | 24 | 319715 | -1 |

| PRI | 12 | 311623 | -4 |

| AYX | 31 | 766712 | 2 |

| Average | 19 | 356439 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $356 million. That figure was $885 million in FLEX’s case. Alteryx, Inc. (NYSE:AYX) is the most popular stock in this table. On the other hand Companhia Energetica de Minas Gerais (NYSE:CIG) is the least popular one with only 9 bullish hedge fund positions. Flex Ltd. (NASDAQ:FLEX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately FLEX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FLEX were disappointed as the stock returned -7.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.