Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does FedEx Corporation (NYSE:FDX) fit the bill? Let’s look at what its recent results tell us about its potential for future gains.

What we’re looking for

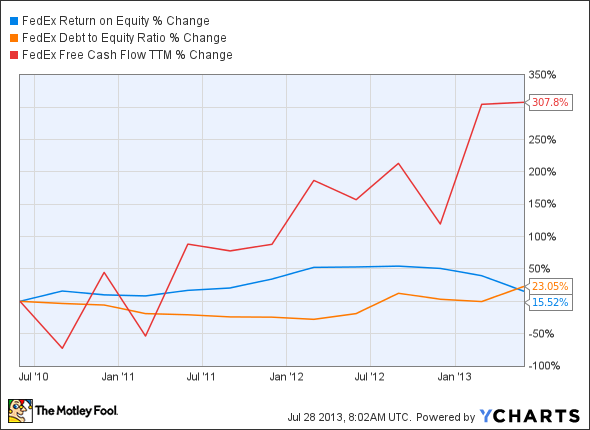

The graphs you’re about to see tell FedEx Corporation (NYSE:FDX)’s story, and we’ll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s take a look at FedEx Corporation (NYSE:FDX)’s key statistics:

FDX Total Return Price data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 22.4% | Fail |

| Improving profit margin | 3.4% | Pass |

| Free cash flow growth > Net income growth | 1,390% vs. 12.9% | Pass |

| Improving EPS | 30.4% | Pass |

| Stock growth (+ 15%) < EPS growth | 41.8% vs. 30.4% | Fail |

Source: YCharts.

*Period begins at end of Q2 (May) 2010.

FDX Return on Equity data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | 15.5% | Pass |

| Declining debt to equity | 23.1% | Fail |

| Dividend growth > 25% | 307.8% | Pass |

| Free cash flow payout ratio < 50% | 13.5% | Pass |

Source: YCharts.

*Period begins at end of Q2 (May) 2010.

How we got here and where we’re going

FedEx Corporation (NYSE:FDX) put together a strong performance, earning six out of nine passing grades and narrowly missing seventh due to slightly underwhelming revenue growth since 2010. A massive debt-raising during last year has certainly cost FedEx a debt-to-equity passing grade as well. Let’s dig a little deeper to see what FedEx is doing to fix these weaknesses and earn a better score.

For the 2013 fiscal year, FedEx Corporation (NYSE:FDX) reported an increase of 3.7% in revenue, but it had problems controlling operating expenses as operating margin fell quite a bit year-over year, from 7.5% in 2012 to 5.8% in 2013. This resulted in a 23% decline in net income to $1.56 billion for the year. One of the measures the company has implemented to cut operating costs is a voluntary employee separation program, in which 3,600 jobs will be cut from the workforce along with a reduction in the operational aircraft fleet. Cutting costs could improve operating margins and help achieve projected EPS growth of 7% to 13% for 2014, but FedEx is a very economically dependent company. If the country isn’t buying, FedEx won’t be delivering.

In an effort to reduce operating expenses, these two companies might begin exploring self-driving trucks as a new route to greater operational efficiencies. Self-driving trucks can evade regulations regarding the length of trucking shifts, and there’s certainly an efficiency argument to be made for eliminating redundant jobs. As a result, FedEx Corporation (NYSE:FDX) wouldn’t have to rely on air transport for as many urgent shipments. Of course, putting thousands out of work will ultimately reduce the demand for packages if the trend ripples across society.

Putting the pieces together

Today, FedEx Corporation (NYSE:FDX) has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy — or to stay away from a stock that’s going nowhere.

The article Is FedEx Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends FedEx and UPS.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.