Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the third quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 5 years and analyze what the smart money thinks of FirstEnergy Corp. (NYSE:FE) based on that data.

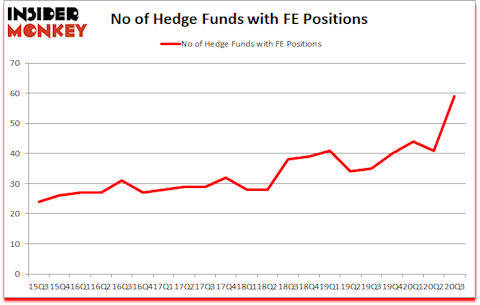

Is FE a good stock to buy now? FirstEnergy Corp. (NYSE:FE) investors should pay attention to an increase in support from the world’s most elite money managers lately. FirstEnergy Corp. (NYSE:FE) was in 59 hedge funds’ portfolios at the end of September. The all time high for this statistics is 44. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 41 hedge funds in our database with FE holdings at the end of June. Our calculations also showed that FE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are assumed to be worthless, old financial vehicles of the past. While there are more than 8000 funds in operation at the moment, Our researchers hone in on the elite of this group, about 850 funds. These hedge fund managers control the lion’s share of all hedge funds’ total asset base, and by shadowing their finest equity investments, Insider Monkey has uncovered numerous investment strategies that have historically exceeded the market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

David Siegel of Two Sigma Advisors

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s take a peek at the key hedge fund action encompassing FirstEnergy Corp. (NYSE:FE).

Hedge fund activity in FirstEnergy Corp. (NYSE:FE)

Heading into the fourth quarter of 2020, a total of 59 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 44% from the previous quarter. By comparison, 35 hedge funds held shares or bullish call options in FE a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Zimmer Partners, managed by Stuart J. Zimmer, holds the most valuable position in FirstEnergy Corp. (NYSE:FE). Zimmer Partners has a $161.3 million position in the stock, comprising 2.5% of its 13F portfolio. The second most bullish fund manager is D E Shaw, managed by D. E. Shaw, which holds a $127.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism include Jeffrey Tannenbaum’s Fir Tree, John Overdeck and David Siegel’s Two Sigma Advisors and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Madison Avenue Partners allocated the biggest weight to FirstEnergy Corp. (NYSE:FE), around 7.83% of its 13F portfolio. Covalis Capital is also relatively very bullish on the stock, earmarking 7.27 percent of its 13F equity portfolio to FE.

Consequently, key hedge funds have been driving this bullishness. Fir Tree, managed by Jeffrey Tannenbaum, initiated the largest position in FirstEnergy Corp. (NYSE:FE). Fir Tree had $125.1 million invested in the company at the end of the quarter. Jos Shaver’s Electron Capital Partners also initiated a $76.4 million position during the quarter. The following funds were also among the new FE investors: Michael A. Price and Amos Meron’s Empyrean Capital Partners, Ari Zweiman’s 683 Capital Partners, and Edward A. Mule’s Silver Point Capital.

Let’s go over hedge fund activity in other stocks similar to FirstEnergy Corp. (NYSE:FE). These stocks are Insulet Corporation (NASDAQ:PODD), Etsy Inc (NASDAQ:ETSY), Quest Diagnostics Incorporated (NYSE:DGX), Slack Technologies Inc (NYSE:WORK), EXACT Sciences Corporation (NASDAQ:EXAS), Bio-Rad Laboratories, Inc. (NYSE:BIO), and Synchrony Financial (NYSE:SYF). This group of stocks’ market caps are similar to FE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PODD | 38 | 1152530 | -6 |

| ETSY | 51 | 1899908 | 8 |

| DGX | 42 | 412437 | -4 |

| WORK | 20 | 164700 | -12 |

| EXAS | 34 | 1113307 | -9 |

| BIO | 48 | 1164966 | -6 |

| SYF | 46 | 1962420 | 0 |

| Average | 39.9 | 1124324 | -4.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.9 hedge funds with bullish positions and the average amount invested in these stocks was $1124 million. That figure was $1286 million in FE’s case. Etsy Inc (NASDAQ:ETSY) is the most popular stock in this table. On the other hand Slack Technologies Inc (NYSE:WORK) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks FirstEnergy Corp. (NYSE:FE) is more popular among hedge funds. Our overall hedge fund sentiment score for FE is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 31.6% in 2020 through December 2nd and still beat the market by 16 percentage points. Unfortunately FE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FE were disappointed as the stock returned -3.5% since the end of the third quarter (through 12/2) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Firstenergy Corp (NYSE:FE)

Follow Firstenergy Corp (NYSE:FE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.