In this article we will take a look at whether hedge funds think Diamondback Energy Inc (NASDAQ:FANG) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

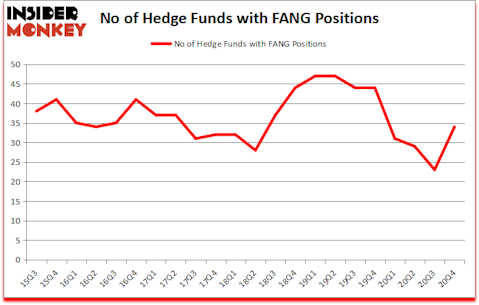

Is FANG stock a buy? The best stock pickers were getting more optimistic. The number of long hedge fund positions improved by 11 in recent months. Diamondback Energy Inc (NASDAQ:FANG) was in 34 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 47. Our calculations also showed that FANG isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Bill Miller of Miller Value Partners

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the CBD market is growing at a 33% annualized rate, so we are taking a closer look at this under-the-radar hemp stock. We go through lists like the 10 best biotech stocks under $10 to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to go over the key hedge fund action encompassing Diamondback Energy Inc (NASDAQ:FANG).

Do Hedge Funds Think FANG Is A Good Stock To Buy Now?

At Q4’s end, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 48% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FANG over the last 22 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of Diamondback Energy Inc (NASDAQ:FANG), with a stake worth $98.4 million reported as of the end of December. Trailing Citadel Investment Group was Arrowstreet Capital, which amassed a stake valued at $94.6 million. Millennium Management, D E Shaw, and Miller Value Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Birch Run Capital allocated the biggest weight to Diamondback Energy Inc (NASDAQ:FANG), around 3.64% of its 13F portfolio. Hill City Capital is also relatively very bullish on the stock, setting aside 2.61 percent of its 13F equity portfolio to FANG.

As industrywide interest jumped, key hedge funds have been driving this bullishness. Miller Value Partners, managed by Bill Miller, created the most valuable position in Diamondback Energy Inc (NASDAQ:FANG). Miller Value Partners had $28.1 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $14.7 million investment in the stock during the quarter. The other funds with brand new FANG positions are Len Kipp and Xavier Majic’s Maple Rock Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Anand Parekh’s Alyeska Investment Group.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Diamondback Energy Inc (NASDAQ:FANG) but similarly valued. These stocks are Woodward Inc (NASDAQ:WWD), BlackLine, Inc. (NASDAQ:BL), Reliance Steel & Aluminum Co. (NYSE:RS), Ritchie Bros. Auctioneers (NYSE:RBA), Sotera Health Company (NASDAQ:SHC), Jones Lang LaSalle Inc (NYSE:JLL), and American Financial Group (NYSE:AFG). This group of stocks’ market values are closest to FANG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WWD | 19 | 674846 | -5 |

| BL | 23 | 324440 | 6 |

| RS | 27 | 364516 | -3 |

| RBA | 23 | 522011 | 2 |

| SHC | 27 | 321284 | 27 |

| JLL | 23 | 1093523 | -2 |

| AFG | 24 | 276298 | -3 |

| Average | 23.7 | 510988 | 3.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.7 hedge funds with bullish positions and the average amount invested in these stocks was $511 million. That figure was $412 million in FANG’s case. Reliance Steel & Aluminum Co. (NYSE:RS) is the most popular stock in this table. On the other hand Woodward Inc (NASDAQ:WWD) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Diamondback Energy Inc (NASDAQ:FANG) is more popular among hedge funds. Our overall hedge fund sentiment score for FANG is 81.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks returned 7.9% in 2021 through April 1st but still managed to beat the market by 0.4 percentage points. Hedge funds were also right about betting on FANG as the stock returned 68.8% since the end of December (through 4/1) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Diamondback Energy Inc. (NASDAQ:FANG)

Follow Diamondback Energy Inc. (NASDAQ:FANG)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.