Some technology companies have quite an innovative business strategy for making money. In this new era of diverse hardware options paired with free or at the least very cheap software, many tech companies have forgone the traditional software model for something different. Instead of users being the customer, the actual revenue often comes from advertisers.

The genesis

We all know the story about how Google Inc (NASDAQ:GOOG)developed its product, search, and then figured out a way to make money off of it. But no one realized just what a hit advertising would be: in 2004, when Google Inc (NASDAQ:GOOG) first became a public company, revenue hit $3 billion. Last year, Google had revenue of over $50 billion.

From 2012. Source: ABCNews

Most of that money comes from ads. It comes from using targeted data with keywords people are searching for and serving up what they want. The best part? Public perception places Google Inc (NASDAQ:GOOG) in high regard. This can be linked to the fact people use Google for something. They realize that the company needs to make money in return for using their services. It’s an exchange that users are more than willing to make with Google.

The user angle with Facebook Inc (NASDAQ:FB)

Facebook Inc (NASDAQ:FB) has had a similar strategy as Google Inc (NASDAQ:GOOG), and this is why people draw comparisons to the two companies. The plan for Facebook from the start was to obtain users, then figure out how to monetize them. And as Facebook Inc (NASDAQ:FB) surpassed 1 billion active users, the company’s revenue has increased: from 2011 to 2012, revenue was up 37% to $5.7 billion.

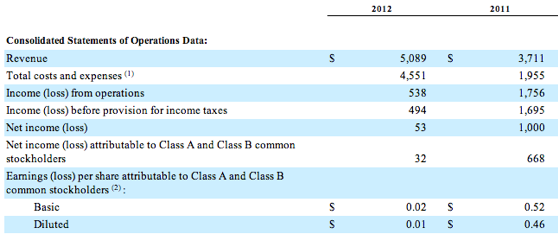

Facebook operations data. Source: Facebook 10-K

Facebook was also profitable in 2012, making a $53 million profit. But, that’s a far cry from the $1 billion profit it made on $3.7 billion in 2011. For the first quarter, income was up slightly, 6% year over year. And the company is making heavy investments in infrastructure. The past two quarters have seen Facebook Inc (NASDAQ:FB) spend a combined $3.9 billion in networking equipment alone.

Making bets

That’s hefty capital spending at a time that Facebook has been criticized recently for poor performance. But investing in all that hardware means that the company continues to believe that it will experience a high degree of growth. Growth in user activity is good for Facebook. But the only question is whether or not Facebook Inc (NASDAQ:FB) can properly monetize its user base’s activities.

Source: Business Insider

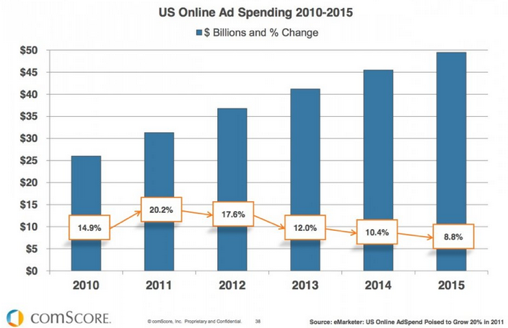

Facebook Inc (NASDAQ:FB)’s not monetizing the way Google Inc (NASDAQ:GOOG) does, at least not under its existing business model. Instead of users voluntarily providing like in a Google search, Facebook leverages the user data that is shared on its platform in order to target advertising and other services to them. Online ad spending is expected to top $40 billion in 2013, so it is trying this within the reality of a growing market.

Services!

Facebook could be the next Google Inc (NASDAQ:GOOG). But in order for that to happen, Facebook needs to come up with its own services people want to use and provide value. For example, Facebook depends on Microsoft Corporation (NASDAQ:MSFT)‘s Bing Maps for results that require geolocation. Facebook and Microsoft have had a relationship going back to Microsoft Corporation (NASDAQ:MSFT) smartly making the decision to invest $240 million in the company during 2007.

Microsoft Online Services Division revenue. Source: Microsoft 2012 10-K

But that investment has left Facebook with sub-par offerings like Bing Maps. Search functionality outside of Facebook’s walls is provided by the Bing search engine. This situation is clearly a play to help Microsoft Corporation (NASDAQ:MSFT)’s Online Services division, which lost $8 billion last year. Microsoft is not a company that offers Facebook any sort of synergy to become like Google. It’s more like a lifeline for Microsoft’s consumer business that continues to flop.

Facebook needs ideas

It seems like Facebook Inc (NASDAQ:FB) is not generating enough ideas for new and innovative services. This seems very akin to a Microsoft mentality rather than a Google one. Remember, Google is constantly launching new services and shuttering those that don’t make money. At the same time, Microsoft launches secondary services that compete with what Google Inc (NASDAQ:GOOG) has found successful in the consumer space (mobile, maps, and search).

Facebook really needs new ideas for user engagement. Mobile is a noble attempt, but what are they doing for the user with this? What is the incentive for a user to plaster Facebook all over their phone? If Facebook wants to be like Google, they need to develop useful services that keep people coming back. One idea that has been rumored is a new chat product. Although the concept of online chatting is not a new idea, this could be something that people will use. Facebook needs it in order to offer that value play to users and continue to grow.

The article Is Facebook the Next Google? originally appeared on Fool.com and is written by Daniel Cawrey.

Daniel Cawrey has no position in any stocks mentioned. The Motley Fool recommends Facebook and Google. The Motley Fool owns shares of Facebook, Google, and Microsoft. Daniel is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.