Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

Extreme Networks, Inc (NASDAQ:EXTR) investors should pay attention to a decrease in enthusiasm from smart money recently. Our calculations also showed that extr isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the latest hedge fund action encompassing Extreme Networks, Inc (NASDAQ:EXTR).

What have hedge funds been doing with Extreme Networks, Inc (NASDAQ:EXTR)?

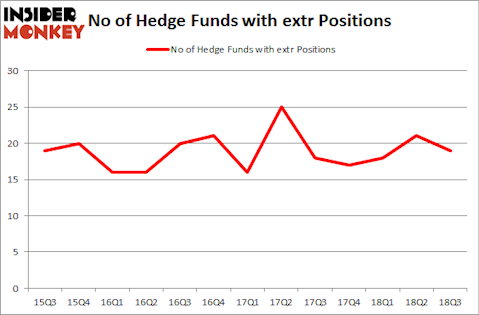

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from one quarter earlier. On the other hand, there were a total of 17 hedge funds with a bullish position in EXTR at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, VIEX Capital Advisors held the most valuable stake in Extreme Networks, Inc (NASDAQ:EXTR), which was worth $19 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $12.4 million worth of shares. Moreover, Alyeska Investment Group, Marshall Wace LLP, and Millennium Management were also bullish on Extreme Networks, Inc (NASDAQ:EXTR), allocating a large percentage of their portfolios to this stock.

Due to the fact that Extreme Networks, Inc (NASDAQ:EXTR) has witnessed declining sentiment from the smart money, it’s easy to see that there lies a certain “tier” of fund managers that decided to sell off their entire stakes by the end of the third quarter. It’s worth mentioning that Randall Yuen’s Jafra Capital Management sold off the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $3.9 million in stock. Bart Baum’s fund, Ionic Capital Management, also dropped its stock, about $2.4 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Extreme Networks, Inc (NASDAQ:EXTR) but similarly valued. We will take a look at Heritage Commerce Corp. (NASDAQ:HTBK), Invesco Trust for Investment Grade Municipals (NYSE:VGM), Globalstar, Inc. (NYSE:GSAT), and Heidrick & Struggles International, Inc. (NASDAQ:HSII). All of these stocks’ market caps resemble EXTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HTBK | 10 | 22853 | 2 |

| VGM | 2 | 341 | 1 |

| GSAT | 22 | 106030 | 3 |

| HSII | 19 | 112007 | 6 |

| Average | 13.25 | 60308 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $82 million in EXTR’s case. Globalstar, Inc. (NYSE:GSAT) is the most popular stock in this table. On the other hand Invesco Trust for Investment Grade Municipals (NYSE:VGM) is the least popular one with only 2 bullish hedge fund positions. Extreme Networks, Inc (NASDAQ:EXTR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GSAT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.