“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Extended Stay America Inc (NYSE:STAY) in order to identify whether reputable and successful top money managers continue to believe in its potential.

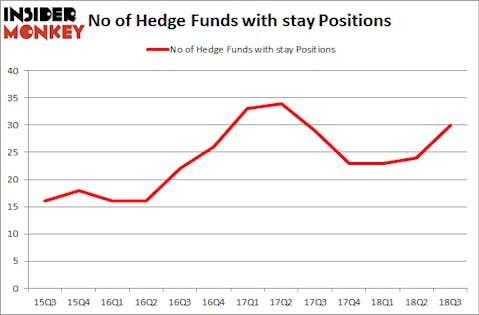

Is Extended Stay America Inc (NYSE:STAY) a buy, sell, or hold? The smart money is getting more bullish. The number of bullish hedge fund bets improved by 6 recently. Our calculations also showed that stay isn’t among the 30 most popular stocks among hedge funds. STAY was in 30 hedge funds’ portfolios at the end of September. There were 24 hedge funds in our database with STAY holdings at the end of the previous quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the latest hedge fund action encompassing Extended Stay America Inc (NYSE:STAY).

How are hedge funds trading Extended Stay America Inc (NYSE:STAY)?

At Q3’s end, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards STAY over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

The largest stake in Extended Stay America Inc (NYSE:STAY) was held by Luxor Capital Group, which reported holding $109.4 million worth of stock at the end of September. It was followed by AEW Capital Management with a $52.3 million position. Other investors bullish on the company included AQR Capital Management, Echo Street Capital Management, and Renaissance Technologies.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Ascend Capital, managed by Malcolm Fairbairn, initiated the most valuable position in Extended Stay America Inc (NYSE:STAY). Ascend Capital had $30 million invested in the company at the end of the quarter. Richard McGuire’s Marcato Capital Management also initiated a $28.5 million position during the quarter. The other funds with brand new STAY positions are Isaac Corre’s Governors Lane, Paul Reeder and Edward Shapiro’s PAR Capital Management, and Amy Minella’s Cardinal Capital.

Let’s now review hedge fund activity in other stocks similar to Extended Stay America Inc (NYSE:STAY). These stocks are Home Bancshares, Inc. (Conway, AR) (NASDAQ:HOMB), Ultragenyx Pharmaceutical Inc (NASDAQ:RARE), United States Cellular Corporation (NYSE:USM), and LaSalle Hotel Properties (NYSE:LHO). This group of stocks’ market caps resemble STAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HOMB | 14 | 30391 | 2 |

| RARE | 17 | 163418 | 6 |

| USM | 15 | 191634 | 2 |

| LHO | 28 | 744016 | -7 |

| Average | 18.5 | 282365 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $282 million. That figure was $495 million in STAY’s case. LaSalle Hotel Properties (NYSE:LHO) is the most popular stock in this table. On the other hand Home Bancshares Inc (NASDAQ:HOMB) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Extended Stay America Inc (NYSE:STAY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.