Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Expedia Inc (NASDAQ:EXPE).

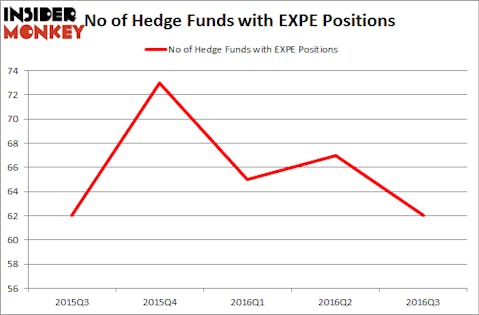

Expedia Inc (NASDAQ:EXPE) was included in the equity portfolios of 62 funds at the end of September. EXPE investors should pay attention to a decrease in hedge fund interest of late, as there had been 67 hedge funds in our database with EXPE holdings at the end of the previous quarter. At the end of this article we will also compare EXPE to other stocks including Liberty Interactive Corp (NASDAQ:QVCA), Nucor Corporation (NYSE:NUE), and Smith & Nephew plc (ADR) (NYSE:SNN) to get a better sense of its popularity.

Follow Expedia Group Inc. (NASDAQ:EXPE)

Follow Expedia Group Inc. (NASDAQ:EXPE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: sidelnikov / 123RF Stock Photo

Keeping this in mind, we’re going to view the recent action surrounding Expedia Inc (NASDAQ:EXPE).

What does the smart money think about Expedia Inc (NASDAQ:EXPE)?

As mentioned previously, heading into the fourth quarter of 2016, 62 funds tracked by Insider Monkey held long positions in this stock, down by 7% from the second quarter of 2016. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Lone Pine Capital, managed by Stephen Mandel, holds the largest position in Expedia Inc (NASDAQ:EXPE). Lone Pine Capital has a $833.8 million position in the stock, comprising 3.7% of its 13F portfolio. Coming in second is PAR Capital Management, led by Paul Reeder and Edward Shapiro, which holds a $828.7 million position; the fund has 12% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise Brad Gerstner’s Altimeter Capital Management, Robert Pitts’ Steadfast Capital Management and Jason Karp’s Tourbillon Capital Partners.