It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Exar Corporation (NASDAQ:EXAR).

Exar Corporation (NASDAQ:EXAR) investors should pay attention to a slight decrease in hedge fund interest lately. At the end of September 14 funds in our database held shares of the company. At the end of this article we will also compare EXAR to other stocks including Timkensteel Corp (NYSE:TMST), Harmonic Inc (NASDAQ:HLIT), and Sierra Wireless, Inc. (USA) (NASDAQ:SWIR) to get a better sense of its popularity.

Follow Exar Corp (NYSE:EXAR)

Follow Exar Corp (NYSE:EXAR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Portogas D Ace/Shutterstock.com

With all of this in mind, we’re going to take a look at the new action encompassing Exar Corporation (NASDAQ:EXAR).

Hedge fund activity in Exar Corporation (NASDAQ:EXAR)

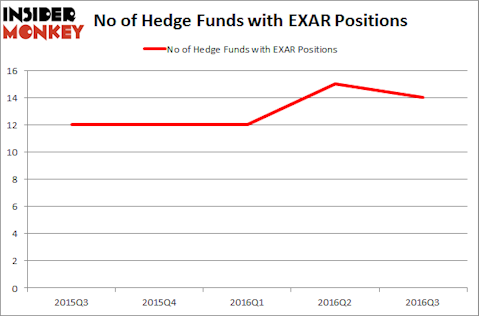

Heading into the fourth quarter of 2016, a total of 14 of the hedge funds tracked by Insider Monkey were long Exar Corporation, down by one fund from the previous quarter. Below, you can check out the change in hedge fund sentiment towards EXAR over the last five quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, led by Chuck Royce, holds the largest position in Exar Corporation (NASDAQ:EXAR). Royce & Associates has a $16.8 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is Simcoe Capital Management, led by Jeffrey Jacobowitz, which holds a $16 million position; the fund has 8.4% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish consist of Renaissance Technologies, one of the largest hedge funds in the world, George Soros’ Soros Fund Management, and Israel Englander’s Millennium Management. We should note that Soros Fund Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.