It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Index returned approximately 12.1% in the first 5 months of this year (through May 30th). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Evolent Health Inc (NYSE:EVH).

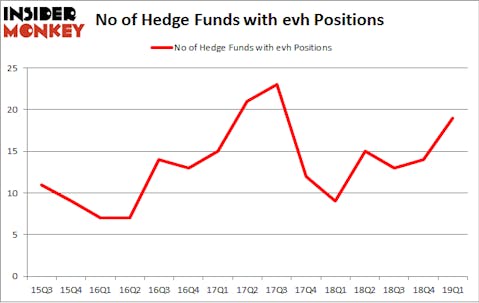

Evolent Health Inc (NYSE:EVH) has seen an increase in activity from the world’s largest hedge funds of late. EVH was in 19 hedge funds’ portfolios at the end of the first quarter of 2019. There were 14 hedge funds in our database with EVH holdings at the end of the previous quarter. Our calculations also showed that evh isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of methods investors can use to grade stocks. A duo of the best methods are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the best money managers can outperform the S&P 500 by a healthy margin (see the details here).

We’re going to take a glance at the key hedge fund action regarding Evolent Health Inc (NYSE:EVH).

How have hedgies been trading Evolent Health Inc (NYSE:EVH)?

Heading into the second quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 36% from the fourth quarter of 2018. By comparison, 9 hedge funds held shares or bullish call options in EVH a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Evolent Health Inc (NYSE:EVH) was held by Sectoral Asset Management, which reported holding $15.2 million worth of stock at the end of March. It was followed by D E Shaw with a $11.7 million position. Other investors bullish on the company included Marshall Wace LLP, Portolan Capital Management, and Casdin Capital.

Consequently, key money managers were leading the bulls’ herd. Birch Grove Capital, managed by Jonathan Berger, created the most valuable position in Evolent Health Inc (NYSE:EVH). Birch Grove Capital had $15.3 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $9.7 million investment in the stock during the quarter. The other funds with new positions in the stock are George McCabe’s Portolan Capital Management, Vishal Saluja and Pham Quang’s Endurant Capital Management, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Evolent Health Inc (NYSE:EVH) but similarly valued. These stocks are Sonos, Inc. (NASDAQ:SONO), Hyster-Yale Materials Handling Inc (NYSE:HY), GameStop Corp. (NYSE:GME), and First Bancorp (NASDAQ:FBNC). This group of stocks’ market values are similar to EVH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SONO | 22 | 75062 | 10 |

| HY | 11 | 35854 | 2 |

| GME | 27 | 88161 | 0 |

| FBNC | 16 | 97868 | 0 |

| Average | 19 | 74236 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $74 million. That figure was $81 million in EVH’s case. GameStop Corp. (NYSE:GME) is the most popular stock in this table. On the other hand Hyster-Yale Materials Handling Inc (NYSE:HY) is the least popular one with only 11 bullish hedge fund positions. Evolent Health Inc (NYSE:EVH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately EVH wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); EVH investors were disappointed as the stock returned -15% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.