We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (read our latest 10 coronavirus predictions).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether Everest Re Group Ltd (NYSE:RE) is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

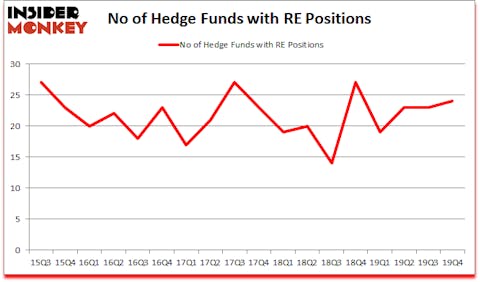

Is Everest Re Group Ltd (NYSE:RE) going to take off soon? Hedge funds are becoming more confident. The number of bullish hedge fund bets inched up by 1 in recent months. Our calculations also showed that RE isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). RE was in 24 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 23 hedge funds in our database with RE holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s take a gander at the fresh hedge fund action surrounding Everest Re Group Ltd (NYSE:RE).

Hedge fund activity in Everest Re Group Ltd (NYSE:RE)

At the end of the fourth quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards RE over the last 18 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

More specifically, AQR Capital Management was the largest shareholder of Everest Re Group Ltd (NYSE:RE), with a stake worth $554.7 million reported as of the end of September. Trailing AQR Capital Management was Point72 Asset Management, which amassed a stake valued at $75.9 million. Polar Capital, Pzena Investment Management, and ZWEIG DIMENNA PARTNERS were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position ZWEIG DIMENNA PARTNERS allocated the biggest weight to Everest Re Group Ltd (NYSE:RE), around 3.19% of its 13F portfolio. Selz Capital is also relatively very bullish on the stock, earmarking 1.46 percent of its 13F equity portfolio to RE.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, assembled the largest position in Everest Re Group Ltd (NYSE:RE). Point72 Asset Management had $75.9 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also initiated a $15.2 million position during the quarter. The following funds were also among the new RE investors: Brandon Haley’s Holocene Advisors, Peter Muller’s PDT Partners, and Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Everest Re Group Ltd (NYSE:RE) but similarly valued. We will take a look at PagSeguro Digital Ltd. (NYSE:PAGS), The Western Union Company (NYSE:WU), Jack Henry & Associates, Inc. (NASDAQ:JKHY), and Vistra Energy Corp. (NYSE:VST). This group of stocks’ market caps match RE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAGS | 21 | 802176 | -15 |

| WU | 29 | 394713 | 6 |

| JKHY | 29 | 259780 | 8 |

| VST | 49 | 2192176 | 4 |

| Average | 32 | 912211 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32 hedge funds with bullish positions and the average amount invested in these stocks was $912 million. That figure was $877 million in RE’s case. Vistra Energy Corp. (NYSE:VST) is the most popular stock in this table. On the other hand PagSeguro Digital Ltd. (NYSE:PAGS) is the least popular one with only 21 bullish hedge fund positions. Everest Re Group Ltd (NYSE:RE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 22.3% in 2020 through March 16th but beat the market by 3.2 percentage points. Unfortunately RE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); RE investors were disappointed as the stock returned -33.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in Q1.

Disclosure: None. This article was originally published at Insider Monkey.