Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

EQT Corporation (NYSE:EQT) shareholders have witnessed a decrease in enthusiasm from smart money recently. Our calculations also showed that EQT isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the latest hedge fund action regarding EQT Corporation (NYSE:EQT).

Hedge fund activity in EQT Corporation (NYSE:EQT)

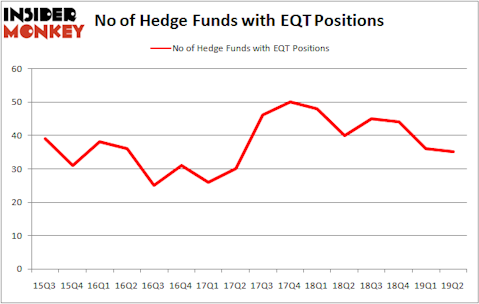

At Q2’s end, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -3% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards EQT over the last 16 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, D E Shaw was the largest shareholder of EQT Corporation (NYSE:EQT), with a stake worth $174.4 million reported as of the end of March. Trailing D E Shaw was Kensico Capital, which amassed a stake valued at $146.3 million. Citadel Investment Group, HBK Investments, and Firefly Value Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Because EQT Corporation (NYSE:EQT) has witnessed declining sentiment from hedge fund managers, we can see that there lies a certain “tier” of hedge funds who were dropping their positions entirely last quarter. Intriguingly, Paul Singer’s Elliott Management sold off the largest position of all the hedgies monitored by Insider Monkey, comprising about $45.1 million in stock. Carl Goldsmith and Scott Klein’s fund, Beach Point Capital Management, also sold off its stock, about $14.8 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 1 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to EQT Corporation (NYSE:EQT). We will take a look at Amedisys Inc (NASDAQ:AMED), FibroGen Inc (NASDAQ:FGEN), ACI Worldwide Inc (NASDAQ:ACIW), and The Timken Company (NYSE:TKR). All of these stocks’ market caps are similar to EQT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMED | 24 | 209888 | -2 |

| FGEN | 16 | 316897 | -5 |

| ACIW | 23 | 356703 | 0 |

| TKR | 26 | 248660 | 0 |

| Average | 22.25 | 283037 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $283 million. That figure was $873 million in EQT’s case. The Timken Company (NYSE:TKR) is the most popular stock in this table. On the other hand FibroGen Inc (NASDAQ:FGEN) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks EQT Corporation (NYSE:EQT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately EQT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EQT were disappointed as the stock returned -32.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.