In this article we will analyze whether Epizyme Inc (NASDAQ:EPZM) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market by double digits annually.

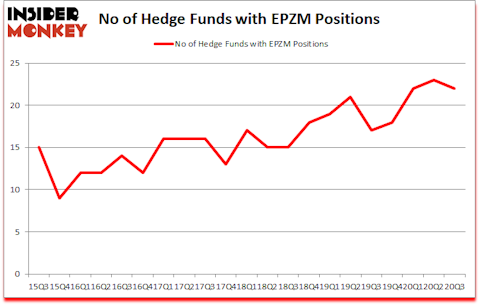

Is EPZM a good stock to buy now? Investors who are in the know were reducing their bets on the stock. The number of bullish hedge fund positions retreated by 1 lately. Epizyme Inc (NASDAQ:EPZM) was in 22 hedge funds’ portfolios at the end of September. The all time high for this statistic is 23. Our calculations also showed that EPZM isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are perceived as unimportant, old financial tools of yesteryear. While there are greater than 8000 funds in operation at present, We hone in on the aristocrats of this group, approximately 850 funds. These money managers administer the majority of the smart money’s total capital, and by keeping track of their first-class equity investments, Insider Monkey has found various investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

Jim Tananbaum of Foresite Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 15 best blue chip stocks to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s take a look at the new hedge fund action regarding Epizyme Inc (NASDAQ:EPZM).

Do Hedge Funds Think EPZM Is A Good Stock To Buy Now?

At the end of September, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the second quarter of 2020. Below, you can check out the change in hedge fund sentiment towards EPZM over the last 21 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Redmile Group, managed by Jeremy Green, holds the number one position in Epizyme Inc (NASDAQ:EPZM). Redmile Group has a $99.2 million position in the stock, comprising 1.8% of its 13F portfolio. Sitting at the No. 2 spot is Palo Alto Investors, managed by William Leland Edwards, which holds a $76.4 million position; the fund has 4.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish include Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Christiana Goh Bardon’s Burrage Capital Management and Jim Tananbaum’s Foresite Capital. In terms of the portfolio weights assigned to each position Burrage Capital Management allocated the biggest weight to Epizyme Inc (NASDAQ:EPZM), around 9.44% of its 13F portfolio. Foresite Capital is also relatively very bullish on the stock, dishing out 8.87 percent of its 13F equity portfolio to EPZM.

Seeing as Epizyme Inc (NASDAQ:EPZM) has witnessed declining sentiment from the aggregate hedge fund industry, logic holds that there were a few hedgies who sold off their entire stakes by the end of the third quarter. Intriguingly, Noam Gottesman’s GLG Partners sold off the biggest position of the “upper crust” of funds monitored by Insider Monkey, totaling close to $5.6 million in stock, and C. Ashton Newhall and James Lim’s Greenspring Associates was right behind this move, as the fund cut about $3.7 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Epizyme Inc (NASDAQ:EPZM) but similarly valued. We will take a look at TechTarget Inc (NASDAQ:TTGT), Encore Capital Group, Inc. (NASDAQ:ECPG), BrightView Holdings, Inc. (NYSE:BV), Argo Group International Holdings, Ltd. (NYSE:ARGO), Viper Energy Partners LP (NASDAQ:VNOM), TowneBank (NASDAQ:TOWN), and INMODE LTD. (NASDAQ:INMD). This group of stocks’ market valuations match EPZM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTGT | 14 | 80553 | 2 |

| ECPG | 20 | 102117 | 3 |

| BV | 15 | 156523 | -3 |

| ARGO | 17 | 175959 | 0 |

| VNOM | 11 | 26145 | 1 |

| TOWN | 12 | 28509 | 3 |

| INMD | 16 | 111188 | 5 |

| Average | 15 | 97285 | 1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $97 million. That figure was $253 million in EPZM’s case. Encore Capital Group, Inc. (NASDAQ:ECPG) is the most popular stock in this table. On the other hand Viper Energy Partners LP (NASDAQ:VNOM) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Epizyme Inc (NASDAQ:EPZM) is more popular among hedge funds. Our overall hedge fund sentiment score for EPZM is 82.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through December 14th and still managed to beat the market by 15.8 percentage points. Hedge funds were also right about betting on EPZM, though not to the same extent, as the stock returned 9.4% since the end of September (through December 14th) and outperformed the market as well.

Follow Epizyme Inc. (NASDAQ:EPZM)

Follow Epizyme Inc. (NASDAQ:EPZM)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.