Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the successful investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the successful funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of EPR Properties (NYSE:EPR) .

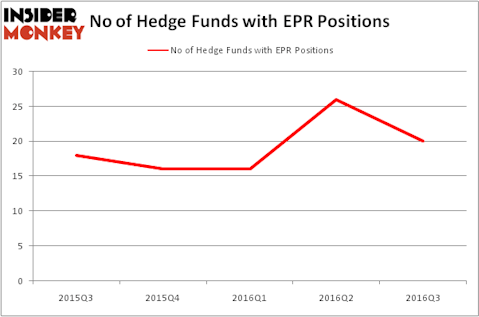

Is EPR Properties (NYSE:EPR) going to take off soon? Investors who are in the know are in a pessimistic mood. The number of long hedge fund investments were trimmed by 6 recently. There were 26 hedge funds in our database with EPR holdings at the end of the previous quarter. At the end of this article we will also compare EPR to other stocks including Weingarten Realty Investors (NYSE:WRI), Opko Health Inc. (NYSE:OPK), and Axis Capital Holdings Limited (NYSE:AXS) to get a better sense of its popularity.

Follow Epr Properties (NYSE:EPR)

Follow Epr Properties (NYSE:EPR)

Receive real-time insider trading and news alerts

With all of this in mind, we’re going to check out the key action encompassing EPR Properties (NYSE:EPR).

Hedge fund activity in EPR Properties (NYSE:EPR)

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -23% from one quarter earlier. On the other hand, there were a total of 16 hedge funds with a bullish position in EPR at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, John Osterweis’s Osterweis Capital Management has the number one position in EPR Properties (NYSE:EPR), worth close to $63.1 million, corresponding to 3.8% of its total 13F portfolio. On Osterweis Capital Management’s heels is Forward Management, led by J. Alan Reid, Jr., holding a $23.9 million position; 1.8% of its 13F portfolio is allocated to the company. Other peers with similar optimism include Amy Minella’s Cardinal Capital, Ken Heebner’s Capital Growth Management and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that Forward Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that sold off their entire stakes in the stock during the third quarter. At the top of the heap, Richard S. Pzena’s Pzena Investment Management sold off the biggest stake of the 700 funds monitored by Insider Monkey, valued at about $23.3 million in stock, and Greg Poole’s Echo Street Capital Management was right behind this move, as the fund sold off about $8.2 million worth of shares.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as EPR Properties (NYSE:EPR) but similarly valued. These stocks are Weingarten Realty Investors (NYSE:WRI), Opko Health Inc. (NYSE:OPK), Axis Capital Holdings Limited (NYSE:AXS), and TIM Participacoes SA (ADR) (NYSE:TSU). This group of stocks’ market valuations resemble EPR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WRI | 10 | 61668 | 0 |

| OPK | 20 | 56078 | 3 |

| AXS | 13 | 482259 | 2 |

| TSU | 13 | 327137 | -3 |

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $232 million. That figure was $172 million in EPR’s case. Opko Health Inc. (NYSE:OPK) is the most popular stock in this table. On the other hand Weingarten Realty Investors (NYSE:WRI) is the least popular one with only 10 bullish hedge fund positions. EPR Properties (NYSE:EPR) is tied with Opko but the total value of hedge fund holdings is almost three times the total value of hedge fund holdings in OPK. This is a positive signal but it isn’t a screaming buy signal. We believe investors at the very least should take a closer look at the stock with an eye towards initiating a small position.