“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Hedge fund interest in Epizyme Inc (NASDAQ:EPZM) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare EPZM to other stocks including Griffon Corporation (NYSE:GFF), Voya Prime Rate Trust (NYSE:PPR), and Nova Measuring Instruments Ltd. (NASDAQ:NVMI) to get a better sense of its popularity.

To most stock holders, hedge funds are seen as slow, outdated investment tools of yesteryear. While there are over 8,000 funds in operation at present, Our experts look at the top tier of this group, about 700 funds. It is estimated that this group of investors oversee the majority of the smart money’s total asset base, and by watching their top picks, Insider Monkey has spotted various investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a look at the recent hedge fund action regarding Epizyme Inc (NASDAQ:EPZM).

How have hedgies been trading Epizyme Inc (NASDAQ:EPZM)?

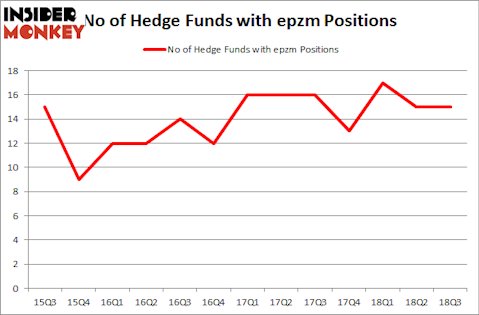

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from one quarter earlier. On the other hand, there were a total of 13 hedge funds with a bullish position in EPZM at the beginning of this year. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Epizyme Inc (NASDAQ:EPZM) was held by Palo Alto Investors, which reported holding $73.2 million worth of stock at the end of September. It was followed by Redmile Group with a $23.8 million position. Other investors bullish on the company included Deerfield Management, Rock Springs Capital Management, and Foresite Capital.

Seeing as Epizyme Inc (NASDAQ:EPZM) has faced falling interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of funds that decided to sell off their full holdings last quarter. At the top of the heap, David Costen Haley’s HBK Investments dumped the biggest stake of all the hedgies followed by Insider Monkey, valued at about $0.9 million in stock. Andrew Feldstein and Stephen Siderow’s fund, Blue Mountain Capital, also dumped its stock, about $0.3 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Epizyme Inc (NASDAQ:EPZM) but similarly valued. These stocks are Griffon Corporation (NYSE:GFF), Voya Prime Rate Trust (NYSE:PPR), Nova Measuring Instruments Ltd. (NASDAQ:NVMI), and Och-Ziff Capital Management Group LLC (NYSE:OZM). This group of stocks’ market valuations are closest to EPZM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GFF | 15 | 114139 | 2 |

| PPR | 5 | 25449 | 2 |

| NVMI | 9 | 71626 | -1 |

| OZM | 9 | 50981 | -1 |

| Average | 9.5 | 65549 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $66 million. That figure was $157 million in EPZM’s case. Griffon Corporation (NYSE:GFF) is the most popular stock in this table. On the other hand Voya Prime Rate Trust (NYSE:PPR) is the least popular one with only 5 bullish hedge fund positions. Epizyme Inc (NASDAQ:EPZM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GFF might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.