At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Envestnet Inc (NYSE:ENV) makes for a good investment right now.

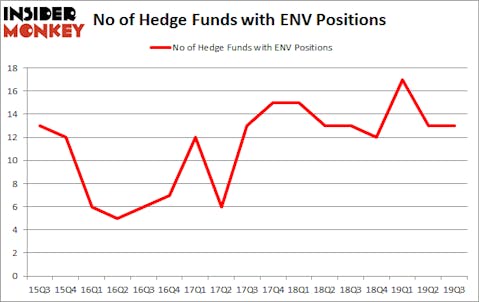

Envestnet Inc (NYSE:ENV) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 13 hedge funds’ portfolios at the end of the third quarter of 2019. At the end of this article we will also compare ENV to other stocks including Telephone & Data Systems, Inc. (NYSE:TDS), Navient Corp (NASDAQ:NAVI), and Apollo Commercial Real Est. Finance Inc (NYSE:ARI) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

James Dinan of York Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to view the fresh hedge fund action encompassing Envestnet Inc (NYSE:ENV).

What have hedge funds been doing with Envestnet Inc (NYSE:ENV)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2019. On the other hand, there were a total of 13 hedge funds with a bullish position in ENV a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, York Capital Management, managed by James Dinan, holds the largest position in Envestnet Inc (NYSE:ENV). York Capital Management has a $22.7 million position in the stock, comprising 1.1% of its 13F portfolio. Coming in second is Select Equity Group, led by Robert Joseph Caruso, holding a $13.6 million position; 0.1% of its 13F portfolio is allocated to the company. Other peers that are bullish consist of David Atterbury’s Whetstone Capital Advisors, Greg Poole’s Echo Street Capital Management and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Whetstone Capital Advisors allocated the biggest weight to Envestnet Inc (NYSE:ENV), around 2.35% of its 13F portfolio. York Capital Management is also relatively very bullish on the stock, setting aside 1.05 percent of its 13F equity portfolio to ENV.

Since Envestnet Inc (NYSE:ENV) has witnessed falling interest from the smart money, it’s safe to say that there exists a select few fund managers that elected to cut their entire stakes in the third quarter. Intriguingly, Ram Seshan Venkateswaran’s Vernier Capital dumped the biggest position of the 750 funds followed by Insider Monkey, comprising an estimated $4.7 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund said goodbye to about $3.9 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Envestnet Inc (NYSE:ENV). These stocks are Telephone & Data Systems, Inc. (NYSE:TDS), Navient Corp (NASDAQ:NAVI), Apollo Commercial Real Est. Finance Inc (NYSE:ARI), and Washington Federal Inc. (NASDAQ:WAFD). This group of stocks’ market values are similar to ENV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TDS | 26 | 301772 | 1 |

| NAVI | 30 | 448459 | 4 |

| ARI | 9 | 55577 | -4 |

| WAFD | 14 | 74488 | 5 |

| Average | 19.75 | 220074 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $220 million. That figure was $64 million in ENV’s case. Navient Corp (NASDAQ:NAVI) is the most popular stock in this table. On the other hand Apollo Commercial Real Est. Finance Inc (NYSE:ARI) is the least popular one with only 9 bullish hedge fund positions. Envestnet Inc (NYSE:ENV) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on ENV as the stock returned 25.6% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.