The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Ellie Mae Inc (NYSE:ELLI).

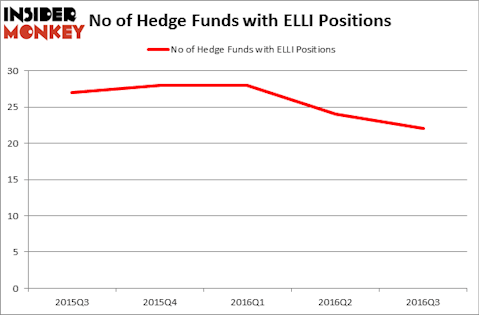

Ellie Mae Inc (NYSE:ELLI) has experienced a decrease in hedge fund sentiment recently. At the end of this article we will also compare ELLI to other stocks including Tenet Healthcare Corp (NYSE:THC), Inovalon Holdings Inc (NASDAQ:INOV), and CoreSite Realty Corp (NYSE:COR) to get a better sense of its popularity.

Follow Ellie Mae Inc (OTCMKTS:ELLI)

Follow Ellie Mae Inc (OTCMKTS:ELLI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Nonwarit/Shutterstock.com

Now, let’s review the recent action regarding Ellie Mae Inc (NYSE:ELLI).

Hedge fund activity in Ellie Mae Inc (NYSE:ELLI)

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 8% from one quarter earlier. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Alex Sacerdote’s Whale Rock Capital Management has the number one position in Ellie Mae Inc (NYSE:ELLI), worth close to $90.4 million and amounting to 5.8% of its total 13F portfolio. Sitting at the No. 2 spot is Park West Asset Management, managed by Peter S. Park, which holds a $42 million position; the fund has 3.8% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish encompass Edmond M. Safra’s EMS Capital, Eduardo Costa’s Calixto Global Investors and Ed Bosek’s BeaconLight Capital.

Due to the fact that Ellie Mae Inc (NYSE:ELLI) has faced a decline in interest from hedge fund managers, it’s safe to say that there exists a select few money managers that slashed their positions entirely heading into Q4. At the top of the heap, Brett Barakett’s Tremblant Capital dumped the largest stake of the “upper crust” of funds followed by Insider Monkey, comprising an estimated $35.4 million in stock. Beeneet Kothari’s fund, Tekne Capital Management, also dropped its stock, about $18.1 million worth of ELLI shares. These transactions are interesting, as total hedge fund interest fell by 2 funds heading into Q4.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Ellie Mae Inc (NYSE:ELLI) but similarly valued. These stocks are Tenet Healthcare Corp (NYSE:THC), Inovalon Holdings Inc (NASDAQ:INOV), CoreSite Realty Corp (NYSE:COR), and FireEye Inc (NASDAQ:FEYE). This group of stocks’ market values resemble ELLI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THC | 39 | 759241 | 0 |

| INOV | 4 | 2747 | -2 |

| COR | 18 | 90393 | 0 |

| FEYE | 29 | 284327 | 2 |

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $284 million. That figure was $263 million in ELLI’s case. Tenet Healthcare Corp (NYSE:THC) is the most popular stock in this table. On the other hand Inovalon Holdings Inc (NASDAQ:INOV) is the least popular one with only 4 bullish hedge fund positions. Ellie Mae Inc (NYSE:ELLI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard THC might be a better candidate to consider a long position.

Disclosure: none.