Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Eaton Vance Corp (NYSE:EV) to find out whether it was one of their high conviction long-term ideas.

Eaton Vance Corp (NYSE:EV) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 15 hedge funds’ portfolios at the end of September. At the end of this article we will also compare EV to other stocks including LG Display Co Ltd. (NYSE:LPL), United Microelectronics Corp (NYSE:UMC), and Dunkin Brands Group Inc (NASDAQ:DNKN) to get a better sense of its popularity.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the latest hedge fund action surrounding Eaton Vance Corp (NYSE:EV).

What have hedge funds been doing with Eaton Vance Corp (NYSE:EV)?

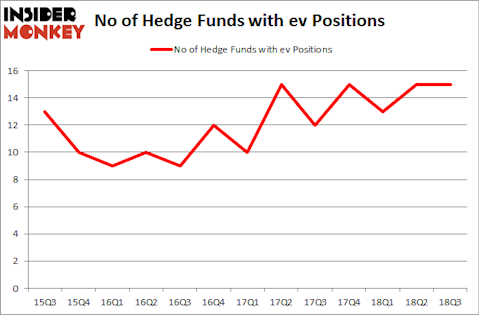

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from the previous quarter. Below, you can check out the change in hedge fund sentiment towards EV over the last 13 quarters. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Millennium Management was the largest shareholder of Eaton Vance Corp (NYSE:EV), with a stake worth $44.4 million reported as of the end of September. Trailing Millennium Management was Citadel Investment Group, which amassed a stake valued at $36.2 million. Balyasny Asset Management, Arrowstreet Capital, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since Eaton Vance Corp (NYSE:EV) has experienced declining sentiment from hedge fund managers, it’s safe to say that there were a few fund managers who sold off their entire stakes in the third quarter. At the top of the heap, James Parsons’s Junto Capital Management said goodbye to the biggest position of all the hedgies followed by Insider Monkey, valued at an estimated $35.7 million in stock, and Sander Gerber’s Hudson Bay Capital Management was right behind this move, as the fund sold off about $10.4 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Eaton Vance Corp (NYSE:EV) but similarly valued. We will take a look at LG Display Co Ltd. (NYSE:LPL), United Microelectronics Corp (NYSE:UMC), Dunkin Brands Group Inc (NASDAQ:DNKN), and RealPage, Inc. (NASDAQ:RP). This group of stocks’ market caps resemble EV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LPL | 6 | 27533 | -3 |

| UMC | 17 | 91798 | 5 |

| DNKN | 12 | 29779 | 1 |

| RP | 27 | 424040 | -1 |

| Average | 15.5 | 143288 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $143 million. That figure was $149 million in EV’s case. RealPage, Inc. (NASDAQ:RP) is the most popular stock in this table. On the other hand LG Display Co Ltd. (NYSE:LPL) is the least popular one with only 6 bullish hedge fund positions. Eaton Vance Corp (NYSE:EV) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.