You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

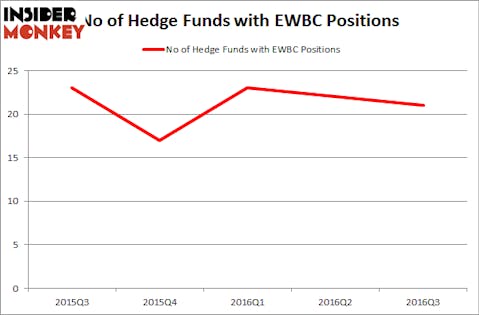

East West Bancorp, Inc. (NASDAQ:EWBC) investors should be aware of a decrease in hedge fund sentiment recently. EWBC was in 21 hedge funds’ portfolios at the end of the third quarter of 2016. There were 22 hedge funds in our database with EWBC holdings at the end of the previous quarter. At the end of this article we will also compare EWBC to other stocks including Brown & Brown, Inc. (NYSE:BRO), CBOE Holdings, Inc (NASDAQ:CBOE), and Cheniere Energy Partners LP Holdings LLC (NYSEMKT:CQH) to get a better sense of its popularity.

Follow East West Bancorp Inc (NASDAQ:EWBC)

Follow East West Bancorp Inc (NASDAQ:EWBC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Kevin George/Shutterstock.com

Now, we’re going to take a gander at the new action regarding East West Bancorp, Inc. (NASDAQ:EWBC).

How are hedge funds trading East West Bancorp, Inc. (NASDAQ:EWBC)?

Heading into the fourth quarter of 2016, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a decline of 5% from one quarter earlier. On the other hand, there were a total of 17 hedge funds with a bullish position in EWBC at the beginning of this year. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Fisher Asset Management, led by Ken Fisher, holds the number one position in East West Bancorp, Inc. (NASDAQ:EWBC). According to regulatory filings, the fund has a $106.8 million position in the stock, comprising 0.2% of its 13F portfolio. The second largest stake is held by Two Sigma Advisors, led by John Overdeck and David Siegel, which holds a $29.4 million position; 0.1% of its 13F portfolio is allocated to the stock. Other members of the smart money that are bullish include Israel Englander’s Millennium Management, Gregg Moskowitz’s Interval Partners and Cliff Asness’s AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.