The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 866 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of March 31st, 2020. What do these smart investors think about E2open Parent Holdings, Inc. (NYSE:ETWO)?

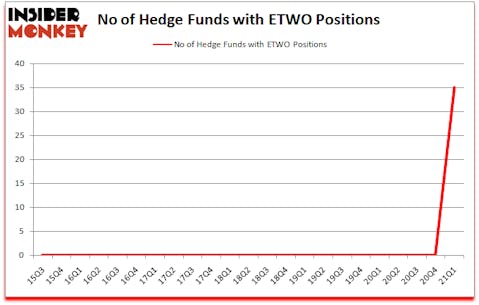

Is ETWO a good stock to buy? Prominent investors were becoming hopeful. The number of long hedge fund positions improved by 35 recently. E2open Parent Holdings, Inc. (NYSE:ETWO) was in 35 hedge funds’ portfolios at the end of March. Our calculations also showed that ETWO isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are a large number of tools shareholders can use to assess publicly traded companies. A pair of the most innovative tools are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the elite investment managers can trounce the market by a superb amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Paul Singer of Elliott Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s view the recent hedge fund action regarding E2open Parent Holdings, Inc. (NYSE:ETWO).

Do Hedge Funds Think ETWO Is A Good Stock To Buy Now?

At the end of March, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 35 from the fourth quarter of 2020. By comparison, 0 hedge funds held shares or bullish call options in ETWO a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in E2open Parent Holdings, Inc. (NYSE:ETWO) was held by Elliott Investment Management, which reported holding $250.7 million worth of stock at the end of December. It was followed by Windacre Partnership with a $177.5 million position. Other investors bullish on the company included Luxor Capital Group, Eminence Capital, and Alyeska Investment Group. In terms of the portfolio weights assigned to each position Altai Capital allocated the biggest weight to E2open Parent Holdings, Inc. (NYSE:ETWO), around 25.47% of its 13F portfolio. Shelter Haven Capital Management is also relatively very bullish on the stock, setting aside 9.27 percent of its 13F equity portfolio to ETWO.

As industrywide interest jumped, some big names have been driving this bullishness. Elliott Investment Management, managed by Paul Singer, created the most outsized position in E2open Parent Holdings, Inc. (NYSE:ETWO). Elliott Investment Management had $250.7 million invested in the company at the end of the quarter. Snehal Amin’s Windacre Partnership also made a $177.5 million investment in the stock during the quarter. The other funds with brand new ETWO positions are Christian Leone’s Luxor Capital Group, Ricky Sandler’s Eminence Capital, and Anand Parekh’s Alyeska Investment Group.

Let’s go over hedge fund activity in other stocks similar to E2open Parent Holdings, Inc. (NYSE:ETWO). These stocks are The ODP Corporation (NASDAQ:ODP), Hub Group Inc (NASDAQ:HUBG), BancFirst Corporation (NASDAQ:BANF), Cactus, Inc. (NYSE:WHD), NIC Inc. (NASDAQ:EGOV), Welbilt, Inc. (NYSE:WBT), and Phreesia, Inc. (NYSE:PHR). This group of stocks’ market values match ETWO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ODP | 24 | 397466 | 4 |

| HUBG | 19 | 229392 | -3 |

| BANF | 4 | 1668 | 2 |

| WHD | 20 | 135752 | 1 |

| EGOV | 34 | 346790 | 19 |

| WBT | 28 | 400427 | 3 |

| PHR | 27 | 213201 | 1 |

| Average | 22.3 | 246385 | 3.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.3 hedge funds with bullish positions and the average amount invested in these stocks was $246 million. That figure was $998 million in ETWO’s case. NIC Inc. (NASDAQ:EGOV) is the most popular stock in this table. On the other hand BancFirst Corporation (NASDAQ:BANF) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks E2open Parent Holdings, Inc. (NYSE:ETWO) is more popular among hedge funds. Our overall hedge fund sentiment score for ETWO is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 19.3% in 2021 through June 25th but still managed to beat the market by 4.8 percentage points. Hedge funds were also right about betting on ETWO as the stock returned 18.5% since the end of March (through 6/25) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow E2Open Parent Holdings Inc. (NYSE:ETWO)

Follow E2Open Parent Holdings Inc. (NYSE:ETWO)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- Billionaire Nelson Peltz’s Favorite Stocks

- Chris Hohn’s Top 10 Stock Picks

Disclosure: None. This article was originally published at Insider Monkey.