At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

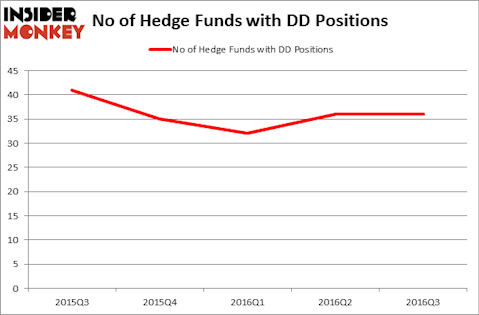

Hedge fund interest in E I Du Pont De Nemours And Co (NYSE:DD) shares was flat at the end of last quarter. This is usually a negative indicator. The stock was held by 36 hedge funds at the end of September, same as at the end of June. At the end of this article we will also compare DD to other stocks including Banco Santander, S.A. (ADR) (NYSE:SAN), Itau Unibanco Holding SA (ADR) (NYSE:ITUB), and BlackRock, Inc. (NYSE:BLK) to get a better sense of its popularity.

Follow Dupont (Old Filings) (NYSE:DD)

Follow Dupont (Old Filings) (NYSE:DD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

foxbat/Shutterstock.com

How have hedgies been trading E I Du Pont De Nemours And Co (NYSE:DD)?

At the end of the third quarter, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the second quarter of 2016. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Nelson Peltz’s Trian Partners has the most valuable position in E I Du Pont De Nemours And Co (NYSE:DD), worth close to $1.1687 billion, comprising 11.4% of its total 13F portfolio. Sitting at the No. 2 spot is Jonathon Jacobson of Highfields Capital Management, with a $522.8 million position; the fund has 4.9% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism consist of Daniel S. Och’s OZ Management, Mason Hawkins’ Southeastern Asset Management and John Overdeck and David Siegel’s Two Sigma Advisors.

Due to the fact that E I Du Pont De Nemours And Co (NYSE:DD) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there were a few hedgies that elected to cut their full holdings in the third quarter. Interestingly, Doug Silverman and Alexander Klabin’s Senator Investment Group cut the biggest stake of the 700 funds tracked by Insider Monkey, comprising close to $13 million in stock, and Clint Carlson’s Carlson Capital was right behind this move, as the fund dropped about $11.3 million worth of shares. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to E I Du Pont De Nemours And Co (NYSE:DD). We will take a look at Banco Santander, S.A. (ADR) (NYSE:SAN), Itau Unibanco Holding SA (ADR) (NYSE:ITUB), BlackRock, Inc. (NYSE:BLK), and The Dow Chemical Company (NYSE:DOW). This group of stocks’ market caps are similar to DD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SAN | 16 | 201876 | 0 |

| ITUB | 24 | 770320 | 2 |

| BLK | 30 | 397378 | 3 |

| DOW | 47 | 2686024 | -1 |

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1.01 billion. That figure was $3.46 billion in DD’s case. The Dow Chemical Company (NYSE:DOW) is the most popular stock in this table. On the other hand Banco Santander, S.A. (ADR) (NYSE:SAN) is the least popular one with only 16 bullish hedge fund positions. E I Du Pont De Nemours And Co (NYSE:DD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DOW might be a better candidate to consider a long position in.

Disclosure: None