Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

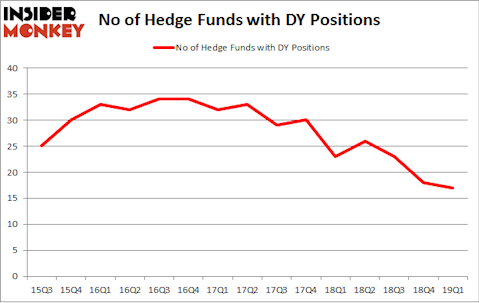

Dycom Industries, Inc. (NYSE:DY) was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. DY investors should pay attention to a decrease in hedge fund interest recently. There were 18 hedge funds in our database with DY holdings at the end of the previous quarter. Our calculations also showed that dy isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the recent hedge fund action regarding Dycom Industries, Inc. (NYSE:DY).

How are hedge funds trading Dycom Industries, Inc. (NYSE:DY)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DY over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

The largest stake in Dycom Industries, Inc. (NYSE:DY) was held by Citadel Investment Group, which reported holding $10.3 million worth of stock at the end of March. It was followed by Millennium Management with a $9.4 million position. Other investors bullish on the company included Buckingham Capital Management, Renaissance Technologies, and Lonestar Capital Management.

Seeing as Dycom Industries, Inc. (NYSE:DY) has experienced declining sentiment from the aggregate hedge fund industry, logic holds that there were a few money managers that slashed their entire stakes by the end of the third quarter. At the top of the heap, Richard S. Meisenberg’s ACK Asset Management dumped the biggest position of all the hedgies followed by Insider Monkey, totaling an estimated $26.4 million in stock, and Michael O’Keefe’s 12th Street Asset Management was right behind this move, as the fund said goodbye to about $13 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Dycom Industries, Inc. (NYSE:DY). These stocks are Horace Mann Educators Corporation (NYSE:HMN), Diamond Offshore Drilling Inc (NYSE:DO), Universal Corp (NYSE:UVV), and Talos Energy, Inc. (NYSE:TALO). All of these stocks’ market caps are similar to DY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HMN | 14 | 28217 | 1 |

| DO | 18 | 66179 | 2 |

| UVV | 17 | 104058 | 2 |

| TALO | 17 | 92558 | 4 |

| Average | 16.5 | 72753 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $60 million in DY’s case. Diamond Offshore Drilling Inc (NYSE:DO) is the most popular stock in this table. On the other hand Horace Mann Educators Corporation (NYSE:HMN) is the least popular one with only 14 bullish hedge fund positions. Dycom Industries, Inc. (NYSE:DY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on DY as the stock returned 21.6% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.