Baron Funds, an asset management firm, published its “Baron Small Cap Fund” first quarter 2021 investor letter – a copy of which can be downloaded here. A return of 2.67% was delivered by the fund’s institutional shares for the Q1 of 2021, trailing the S&P 500 Index, which appreciated 6.17%, and modestly underperforming the Russell 2000 Growth Index which rose 4.88% for the same period. You can view the fund’s top 5 holdings to have a peek at their top bets for 2021.

Baron Small Cap Fund, in its Q1 2021 investor letter, mentioned Driven Brands Holdings Inc. (NASDAQ: DRVN), and shared their insights on the company. Driven Brands Holdings Inc. is a Charlotte, North Carolina-based automotive repair center that currently has a $4.7 billion market capitalization. Since the beginning of the year, DRVN delivered a 71.00% return, and as of May 14, 2021, the stock closed at $28.13 per share.

Here is what Baron Small Cap Fund has to say about Driven Brands Holdings Inc.in its Q1 2021 investor letter:

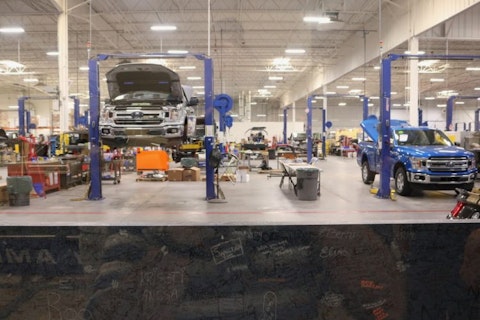

“We participated in the Driven Brands Holdings Inc. IPO during the quarter. Driven is the largest automotive services company in North America with a growing and mostly franchised base of more than 4,100 locations across 49 U.S. states and 14 international countries. Driven’s scaled platform fulfills a wide range of core automotive needs-based services, including paint, collision, glass, vehicle repair, oil change, maintenance, and car wash.

Even as the largest player, Driven’s market share remains low (1% to 4% depending on category), and we believe the company can triple its unit count to 12,000 over time supported by the extreme fragmentation of the industry and strong unit economics of each concept. The long-term industry demand drivers, such as the aging vehicle fleet and increasing vehicle complexity, provide a nice tailwind as well. Driven enjoys scale benefits versus small chains or independents in the form of purchasing power, marketing budget, data analytics, and B2B relationships with insurance partners and fleet vehicles. We are also attracted to Driven’s franchise business model. Franchisees represent over 75% of systemwide sales resulting in a strong recurring revenue/cash flow model. Driven should benefit as consumers get back to driving their cars as we exit the pandemic.

We expect organic revenue to grow from $1.1 billion in 2020 to over $1.7 billion in 2025 driven by a combination of mid-single-digit unit growth and low single-digit same store sales. Driven has posted 12 consecutive years of same store sales growth with an average of around 4%. Over the past five years, total revenues have grown at a 37% CAGR as management has displayed a strong track record of executing accretive M&A. We expect that trend to continue, fueling high-teens EBITDA growth.”

laurel-and-michael-evans-c-KDq7nxVdQ-unsplash

Our calculations show that Driven Brands Holdings Inc. (NASDAQ: DRVN) does not belong in our list of the 30 Most Popular Stocks Among Hedge Funds. DRVN delivered a -18.46% return in the past 3 months.

The top 10 stocks among hedge funds returned 231.2% between 2015 and 2020, and outperformed the S&P 500 Index ETFs by more than 126 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Here you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 15 best innovative stocks to buy to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website:

Disclosure: None. This article is originally published at Insider Monkey.