Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The one and a half month time period since the end of the third quarter is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Donnelley Financial Solutions, Inc. (NYSE:DFIN).

Donnelley Financial Solutions, Inc. (NYSE:DFIN) has seen a decrease in enthusiasm from smart money of late. Nevertheless, we decided to publish this article after Jeffrey Jacobowitz’s hedge fund filed a 13D and said the following about DFIN:

The Reporting Persons purchased the Shares based on the Reporting Persons’ belief that the Shares, when purchased, were and continue to be substantially undervalued, particularly when considering the Issuer’s growing software as a service (SaaS) revenue streams and strong, consistent free cash flow generation. The Reporting Persons are supportive of the Issuer’s management team as well as the operating performance of the Issuer and are pleased with the five-year projected forecast laid out at the Issuer’s May 2018 investor day, where free cash flow was projected to grow at a 13% CAGR through 2022 – cumulatively well in excess of $300 million (approximately $10 per share).

The Reporting Persons are nevertheless concerned about:

– the -28% total shareholder return generated since the Issuer’s spin-off from R.R. Donnelley & Sons Company in October 2016 versus the Russell 2000 at +21%;

– the exceedingly discounted valuation at which the Issuer trades (EV/2018e EBITDA of 5.2x – adjusted for expected year end cash balance);

– the absence of a shareholder capital return program;

– the ongoing perception by many investors that the Issuer is a print oriented company; and

– the intended utilization of in excess of $300 million in cumulative free cash expected to be generated through 2022.

In the 21st century investor’s toolkit there are plenty of indicators stock market investors can use to grade stocks. A couple of the less utilized indicators are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best hedge fund managers can trounce the market by a superb amount (see the details here).

We’re going to take a peek at the recent hedge fund action regarding Donnelley Financial Solutions, Inc. (NYSE:DFIN).

How have hedgies been trading Donnelley Financial Solutions, Inc. (NYSE:DFIN)?

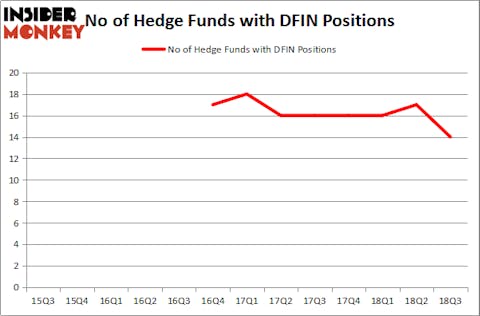

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -18% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in DFIN heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Simcoe Capital Management, managed by Jeffrey Jacobowitz, holds the biggest position in Donnelley Financial Solutions, Inc. (NYSE:DFIN). Simcoe Capital Management has a $30.2 million position in the stock, comprising 8.2% of its 13F portfolio. Coming in second is Israel Englander of Millennium Management, with a $9.9 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism consist of D. E. Shaw’s D E Shaw, Mark Travis’s Intrepid Capital Management and Peter Algert and Kevin Coldiron’s Algert Coldiron Investors.

Because Donnelley Financial Solutions, Inc. (NYSE:DFIN) has witnessed declining sentiment from hedge fund managers, logic holds that there was a specific group of funds who were dropping their full holdings heading into Q3. Interestingly, Ken Griffin’s Citadel Investment Group cut the largest stake of all the hedgies followed by Insider Monkey, comprising close to $2.8 million in stock, and Bradley LouisáRadoff’s Fondren Management was right behind this move, as the fund sold off about $2.1 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 3 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Donnelley Financial Solutions, Inc. (NYSE:DFIN) but similarly valued. These stocks are Hoegh LNG Partners LP (NYSE:HMLP), DMC Global Inc. (NASDAQ:BOOM), e.l.f. Beauty, Inc. (NYSE:ELF), and Impinj, Inc. (NASDAQ:PI). This group of stocks’ market caps match DFIN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HMLP | 5 | 28132 | -1 |

| BOOM | 16 | 75717 | 1 |

| ELF | 11 | 106824 | 1 |

| PI | 9 | 149084 | 3 |

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $90 million. That figure was $54 million in DFIN’s case. Dynamic Materials Corporation (NASDAQ:BOOM) is the most popular stock in this table. On the other hand Hoegh LNG Partners LP (NYSE:HMLP) is the least popular one with only 5 bullish hedge fund positions. Donnelley Financial Solutions, Inc. (NYSE:DFIN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BOOM might be a better candidate to consider a long position. Alternatively, investors could consider one of the 30 most popular stocks among hedge funds.

Disclosure: None. This article was originally published at Insider Monkey.