A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 28, so let’s proceed with the discussion of the hedge fund sentiment on Donaldson Company, Inc. (NYSE:DCI).

Hedge fund interest in Donaldson Company, Inc. (NYSE:DCI) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Reliance Steel & Aluminum Co. (NYSE:RS), Starwood Property Trust, Inc. (NYSE:STWD), and Companhia Brasileira de Distrib. (NYSE:CBD) to gather more data points. Our calculations also showed that DCI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the fresh hedge fund action regarding Donaldson Company, Inc. (NYSE:DCI).

Hedge fund activity in Donaldson Company, Inc. (NYSE:DCI)

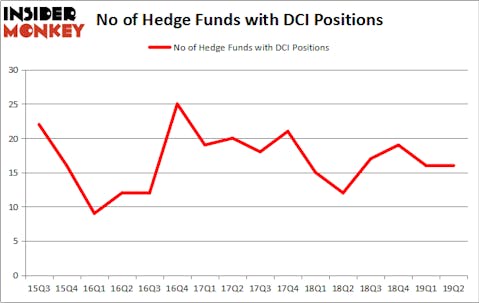

At Q2’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 12 hedge funds with a bullish position in DCI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Impax Asset Management held the most valuable stake in Donaldson Company, Inc. (NYSE:DCI), which was worth $42.9 million at the end of the second quarter. On the second spot was GAMCO Investors which amassed $42.7 million worth of shares. Moreover, Arrowstreet Capital, Citadel Investment Group, and Millennium Management were also bullish on Donaldson Company, Inc. (NYSE:DCI), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Donaldson Company, Inc. (NYSE:DCI) has faced falling interest from the entirety of the hedge funds we track, logic holds that there were a few money managers that slashed their positions entirely last quarter. It’s worth mentioning that Ken Griffin’s Citadel Investment Group dropped the largest stake of all the hedgies watched by Insider Monkey, worth an estimated $0.7 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund dumped about $0.5 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Donaldson Company, Inc. (NYSE:DCI) but similarly valued. We will take a look at Reliance Steel & Aluminum Co. (NYSE:RS), Starwood Property Trust, Inc. (NYSE:STWD), Companhia Brasileira de Distrib. (NYSE:CBD), and Brookfield Renewable Partners L.P. (NYSE:BEP). This group of stocks’ market caps match DCI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RS | 19 | 287950 | -4 |

| STWD | 14 | 136432 | -1 |

| CBD | 11 | 62442 | -1 |

| BEP | 4 | 7705 | 1 |

| Average | 12 | 123632 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $124 million. That figure was $152 million in DCI’s case. Reliance Steel & Aluminum Co. (NYSE:RS) is the most popular stock in this table. On the other hand Brookfield Renewable Partners L.P. (NYSE:BEP) is the least popular one with only 4 bullish hedge fund positions. Donaldson Company, Inc. (NYSE:DCI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on DCI, though not to the same extent, as the stock returned 2.8% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.