Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we publish an article with the title “Recession is Imminent: We Need A Travel Ban NOW”. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Dollar General Corp. (NYSE:DG).

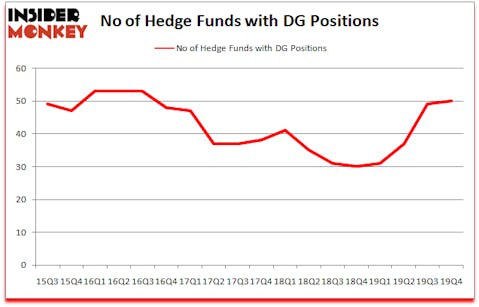

Dollar General Corp. (NYSE:DG) investors should be aware of an increase in hedge fund interest in recent months. DG was in 50 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 49 hedge funds in our database with DG positions at the end of the previous quarter. Our calculations also showed that DG isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Steven Cohen of Point72 Asset Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind let’s take a glance at the recent hedge fund action encompassing Dollar General Corp. (NYSE:DG).

What does smart money think about Dollar General Corp. (NYSE:DG)?

At Q4’s end, a total of 50 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from the third quarter of 2019. On the other hand, there were a total of 30 hedge funds with a bullish position in DG a year ago. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in Dollar General Corp. (NYSE:DG) was held by Two Sigma Advisors, which reported holding $272.9 million worth of stock at the end of September. It was followed by Orbis Investment Management with a $264.6 million position. Other investors bullish on the company included AQR Capital Management, Point72 Asset Management, and Millennium Management. In terms of the portfolio weights assigned to each position 12th Street Asset Management allocated the biggest weight to Dollar General Corp. (NYSE:DG), around 7.34% of its 13F portfolio. Emerson Point Capital is also relatively very bullish on the stock, setting aside 5.23 percent of its 13F equity portfolio to DG.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Dollar General Corp. (NYSE:DG) headfirst. Candlestick Capital Management, managed by Jack Woodruff, established the most outsized position in Dollar General Corp. (NYSE:DG). Candlestick Capital Management had $35.6 million invested in the company at the end of the quarter. Alexander Mitchell’s Scopus Asset Management also initiated a $15.5 million position during the quarter. The other funds with new positions in the stock are Brian Scudieri’s Kehrs Ridge Capital, Benjamin A. Smith’s Laurion Capital Management, and Parvinder Thiara’s Athanor Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Dollar General Corp. (NYSE:DG) but similarly valued. We will take a look at Manulife Financial Corporation (NYSE:MFC), FedEx Corporation (NYSE:FDX), The Kraft Heinz Company (NASDAQ:KHC), and NetEase, Inc (NASDAQ:NTES). This group of stocks’ market valuations match DG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MFC | 19 | 284486 | 0 |

| FDX | 45 | 1481070 | 0 |

| KHC | 34 | 10747172 | -5 |

| NTES | 44 | 3818274 | 12 |

| Average | 35.5 | 4082751 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.5 hedge funds with bullish positions and the average amount invested in these stocks was $4083 million. That figure was $2076 million in DG’s case. FedEx Corporation (NYSE:FDX) is the most popular stock in this table. On the other hand Manulife Financial Corporation (NYSE:MFC) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Dollar General Corp. (NYSE:DG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but still managed to beat the market by 1.9 percentage points. Hedge funds were also right about betting on DG as the stock returned 2.3% so far in Q1 (through March 9th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.