Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Discovery, Inc. (NASDAQ:DISCA).

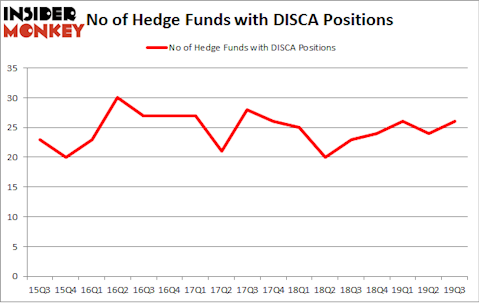

Is Discovery, Inc. (NASDAQ:DISCA) a healthy stock for your portfolio? The best stock pickers are in a bullish mood. The number of bullish hedge fund positions inched up by 2 recently. Our calculations also showed that DISCA isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). DISCA was in 26 hedge funds’ portfolios at the end of September. There were 24 hedge funds in our database with DISCA positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s view the key hedge fund action encompassing Discovery, Inc. (NASDAQ:DISCA).

What does smart money think about Discovery, Inc. (NASDAQ:DISCA)?

Heading into the fourth quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from one quarter earlier. On the other hand, there were a total of 23 hedge funds with a bullish position in DISCA a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the most valuable position in Discovery, Inc. (NASDAQ:DISCA). Citadel Investment Group has a $114.6 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Steven Tananbaum of GoldenTree Asset Management, with a $56.3 million position; the fund has 8.1% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism comprise Stuart J. Zimmer’s Zimmer Partners, Bill Miller’s Miller Value Partners and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position GoldenTree Asset Management allocated the biggest weight to Discovery, Inc. (NASDAQ:DISCA), around 8.14% of its portfolio. Miller Value Partners is also relatively very bullish on the stock, earmarking 1.77 percent of its 13F equity portfolio to DISCA.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into Discovery, Inc. (NASDAQ:DISCA) headfirst. Wexford Capital, managed by Charles Davidson and Joseph Jacobs, established the biggest position in Discovery, Inc. (NASDAQ:DISCA). Wexford Capital had $2.5 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also initiated a $2.1 million position during the quarter. The other funds with new positions in the stock are Renee Yao’s Neo Ivy Capital, Alec Litowitz and Ross Laser’s Magnetar Capital, and Peter Algert and Kevin Coldiron’s Algert Coldiron Investors.

Let’s now take a look at hedge fund activity in other stocks similar to Discovery, Inc. (NASDAQ:DISCA). These stocks are Broadridge Financial Solutions, Inc. (NYSE:BR), Seagate Technology plc (NASDAQ:STX), UDR, Inc. (NYSE:UDR), and Banco de Chile (NYSE:BCH). This group of stocks’ market caps are closest to DISCA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BR | 27 | 312931 | 6 |

| STX | 26 | 2311475 | 3 |

| UDR | 21 | 560389 | 5 |

| BCH | 4 | 66263 | -2 |

| Average | 19.5 | 812765 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $813 million. That figure was $419 million in DISCA’s case. Broadridge Financial Solutions, Inc. (NYSE:BR) is the most popular stock in this table. On the other hand Banco de Chile (NYSE:BCH) is the least popular one with only 4 bullish hedge fund positions. Discovery, Inc. (NASDAQ:DISCA) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on DISCA as the stock returned 23.7% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.