Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the second quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 6.6 percentage points through May 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

Is Discover Financial Services (NYSE:DFS) worth your attention right now? Money managers are taking a pessimistic view. The number of bullish hedge fund positions fell by 1 in recent months. Our calculations also showed that DFS isn’t among the 30 most popular stocks among hedge funds.

Today there are a large number of tools stock traders use to assess stocks. A duo of the less utilized tools are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best investment managers can outpace the market by a very impressive margin (see the details here).

We’re going to analyze the recent hedge fund action surrounding Discover Financial Services (NYSE:DFS).

Hedge fund activity in Discover Financial Services (NYSE:DFS)

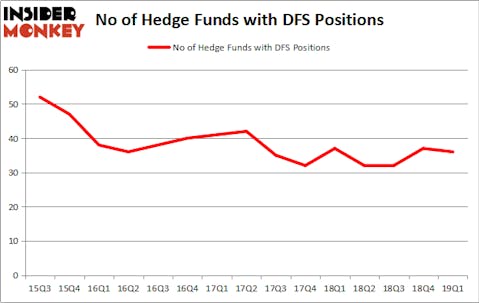

Heading into the second quarter of 2019, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -3% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DFS over the last 15 quarters. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ric Dillon’s Diamond Hill Capital has the most valuable position in Discover Financial Services (NYSE:DFS), worth close to $374.2 million, accounting for 2.1% of its total 13F portfolio. The second most bullish fund manager is GLG Partners, managed by Noam Gottesman, which holds a $59.9 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise Cliff Asness’s AQR Capital Management, Israel Englander’s Millennium Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Because Discover Financial Services (NYSE:DFS) has faced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there were a few hedge funds that slashed their positions entirely by the end of the third quarter. At the top of the heap, Richard Rubin’s Hawkeye Capital said goodbye to the largest position of the 700 funds tracked by Insider Monkey, valued at close to $15.3 million in stock. Ravi Chopra’s fund, Azora Capital, also sold off its stock, about $13.3 million worth. These moves are important to note, as total hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Discover Financial Services (NYSE:DFS) but similarly valued. We will take a look at Fiat Chrysler Automobiles NV (NYSE:FCAU), Sprint Corporation (NYSE:S), Motorola Solutions Inc (NYSE:MSI), and Mercadolibre Inc (NASDAQ:MELI). This group of stocks’ market values match DFS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FCAU | 27 | 2246774 | -7 |

| S | 24 | 618801 | 0 |

| MSI | 29 | 835065 | 6 |

| MELI | 41 | 2802210 | 10 |

| Average | 30.25 | 1625713 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $1626 million. That figure was $742 million in DFS’s case. Mercadolibre Inc (NASDAQ:MELI) is the most popular stock in this table. On the other hand Sprint Corporation (NYSE:S) is the least popular one with only 24 bullish hedge fund positions. Discover Financial Services (NYSE:DFS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on DFS as the stock returned 7.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.