The market has been volatile as the Federal Reserve continues its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points through November 16th. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Dime Community Bancshares, Inc. (NASDAQ:DCOM) and find out how it is affected by hedge funds’ moves.

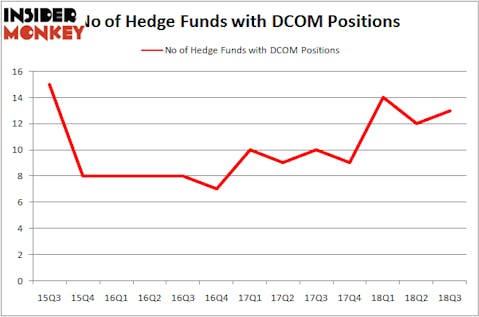

Dime Community Bancshares, Inc. (NASDAQ:DCOM) was in 13 hedge funds’ portfolios at the end of the third quarter of 2018. DCOM investors should be aware of an increase in hedge fund interest recently. There were 12 hedge funds in our database with DCOM positions at the end of the previous quarter. Our calculations also showed that DCOM isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Cliff Asness of AQR Capital Management

We’re going to take a peek at the recent hedge fund action regarding Dime Community Bancshares, Inc. (NASDAQ:DCOM).

How have hedgies been trading Dime Community Bancshares, Inc. (NASDAQ:DCOM)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DCOM over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Dime Community Bancshares, Inc. (NASDAQ:DCOM) was held by Polaris Capital Management, which reported holding $17.2 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $6.7 million position. Other investors bullish on the company included AQR Capital Management, Castine Capital Management, and Ulysses Management.

As aggregate interest increased, some big names have been driving this bullishness. Castine Capital Management, managed by Paul Magidson, Jonathan Cohen. And Ostrom Enders, created the biggest position in Dime Community Bancshares, Inc. (NASDAQ:DCOM). Castine Capital Management had $4.6 million invested in the company at the end of the quarter. John D. Gillespie’s Prospector Partners also initiated a $2.9 million position during the quarter. The only other fund with a brand new DCOM position is Israel Englander’s Millennium Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Dime Community Bancshares, Inc. (NASDAQ:DCOM) but similarly valued. We will take a look at Kura Oncology, Inc. (NASDAQ:KURA), Scorpio Tankers Inc. (NYSE:STNG), Matrix Service Co (NASDAQ:MTRX), and Pennsylvania Real Estate Investment Trust (NYSE:PEI). This group of stocks’ market caps are closest to DCOM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KURA | 20 | 217308 | 2 |

| STNG | 14 | 62267 | -1 |

| MTRX | 12 | 61071 | 1 |

| PEI | 14 | 59225 | 3 |

| Average | 15 | 99968 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $100 million. That figure was $43 million in DCOM’s case. Kura Oncology, Inc. (NASDAQ:KURA) is the most popular stock in this table. On the other hand Matrix Service Co (NASDAQ:MTRX) is the least popular one with only 12 bullish hedge fund positions. Dime Community Bancshares, Inc. (NASDAQ:DCOM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KURA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.