Is Delta Apparel, Inc. (NYSE:DLA) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

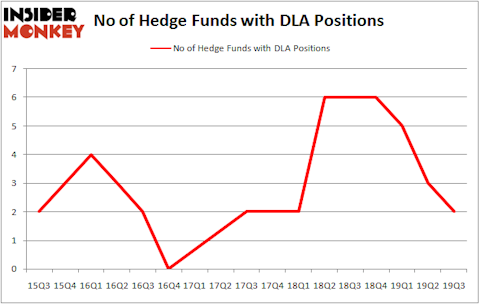

Delta Apparel, Inc. (NYSE:DLA) was in 2 hedge funds’ portfolios at the end of September. DLA has experienced a decrease in hedge fund sentiment lately. There were 3 hedge funds in our database with DLA positions at the end of the previous quarter. Our calculations also showed that DLA isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Jim Simons founder of Renaissance Technologies

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the fresh hedge fund action encompassing Delta Apparel, Inc. (NYSE:DLA).

Hedge fund activity in Delta Apparel, Inc. (NYSE:DLA)

Heading into the fourth quarter of 2019, a total of 2 of the hedge funds tracked by Insider Monkey were long this stock, a change of -33% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DLA over the last 17 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, Deep Field Asset Management was the largest shareholder of Delta Apparel, Inc. (NYSE:DLA), with a stake worth $7.1 million reported as of the end of September. Trailing Deep Field Asset Management was Renaissance Technologies, which amassed a stake valued at $0.3 million.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Ancora Advisors. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified DLA as a viable investment and initiated a position in the stock.

Let’s now review hedge fund activity in other stocks similar to Delta Apparel, Inc. (NYSE:DLA). We will take a look at Inspired Entertainment, Inc. (NASDAQ:INSE), Luna Innovations Incorporated (NASDAQ:LUNA), Red Lion Hotels Corporation (NYSE:RLH), and 1st Constitution Bancorp (NASDAQ:FCCY). This group of stocks’ market caps resemble DLA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INSE | 6 | 35260 | 0 |

| LUNA | 7 | 12148 | 4 |

| RLH | 13 | 48296 | 4 |

| FCCY | 1 | 2359 | 0 |

| Average | 6.75 | 24516 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $7 million in DLA’s case. Red Lion Hotels Corporation (NYSE:RLH) is the most popular stock in this table. On the other hand 1st Constitution Bancorp (NASDAQ:FCCY) is the least popular one with only 1 bullish hedge fund positions. Delta Apparel, Inc. (NYSE:DLA) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. A small number of hedge funds were also right about betting on DLA as the stock returned 14.2% during Q4 (through 11/22) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.