At Insider Monkey, we pore over the filings of nearly 887 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31st. In this article, we will use that wealth of knowledge to determine whether or not Dell Technologies Inc. (NYSE:DELL) makes for a good investment right now.

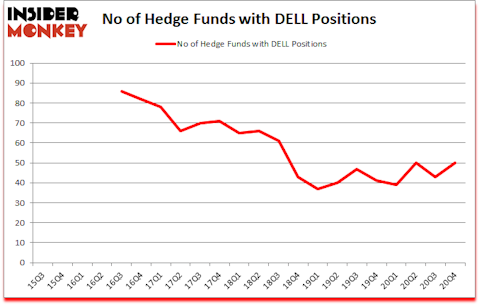

Is DELL stock a buy or sell? Dell Technologies Inc. (NYSE:DELL) has experienced an increase in hedge fund sentiment in recent months. Dell Technologies Inc. (NYSE:DELL) was in 50 hedge funds’ portfolios at the end of December. The all time high for this statistic is 86. There were 43 hedge funds in our database with DELL holdings at the end of September. Our calculations also showed that DELL isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). Keeping this in mind let’s view the key hedge fund action regarding Dell Technologies Inc. (NYSE:DELL).

Do Hedge Funds Think DELL Is A Good Stock To Buy Now?

At Q4’s end, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of 16% from the previous quarter. By comparison, 41 hedge funds held shares or bullish call options in DELL a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Dell Technologies Inc. (NYSE:DELL) was held by Elliott Investment Management, which reported holding $1820 million worth of stock at the end of December. It was followed by Canyon Capital Advisors with a $456.2 million position. Other investors bullish on the company included Lyrical Asset Management, Point72 Asset Management, and First Pacific Advisors LLC. In terms of the portfolio weights assigned to each position HighVista Strategies allocated the biggest weight to Dell Technologies Inc. (NYSE:DELL), around 31.86% of its 13F portfolio. Canyon Capital Advisors is also relatively very bullish on the stock, setting aside 19.69 percent of its 13F equity portfolio to DELL.

Consequently, specific money managers were leading the bulls’ herd. Impax Asset Management, managed by Ian Simm, established the biggest position in Dell Technologies Inc. (NYSE:DELL). Impax Asset Management had $20.1 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $13.8 million investment in the stock during the quarter. The other funds with brand new DELL positions are Matthew Hulsizer’s PEAK6 Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors.

Let’s now take a look at hedge fund activity in other stocks similar to Dell Technologies Inc. (NYSE:DELL). We will take a look at Analog Devices, Inc. (NASDAQ:ADI), Equinor ASA (NYSE:EQNR), Moody’s Corporation (NYSE:MCO), Twilio Inc. (NYSE:TWLO), Humana Inc (NYSE:HUM), Illumina, Inc. (NASDAQ:ILMN), and Westpac Banking Corporation (NYSE:WBK). This group of stocks’ market values resemble DELL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADI | 58 | 5319785 | 6 |

| EQNR | 18 | 238582 | -2 |

| MCO | 59 | 11352402 | -1 |

| TWLO | 94 | 5011455 | 23 |

| HUM | 59 | 3966420 | -2 |

| ILMN | 45 | 1747647 | 1 |

| WBK | 3 | 29715 | -1 |

| Average | 48 | 3952287 | 3.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 48 hedge funds with bullish positions and the average amount invested in these stocks was $3952 million. That figure was $3909 million in DELL’s case. Twilio Inc. (NYSE:TWLO) is the most popular stock in this table. On the other hand Westpac Banking Corporation (NYSE:WBK) is the least popular one with only 3 bullish hedge fund positions. Dell Technologies Inc. (NYSE:DELL) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DELL is 53.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Hedge funds were also right about betting on DELL as the stock returned 19.6% since the end of Q4 (through 3/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Dell Technologies Inc. (NYSE:DELL)

Follow Dell Technologies Inc. (NYSE:DELL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.