Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th. In this article we are going to take a look at smart money sentiment towards Data I/O Corporation (NASDAQ:DAIO).

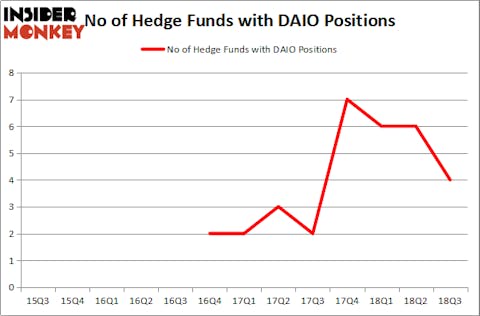

Is Data I/O Corporation (NASDAQ:DAIO) a buy, sell, or hold? Prominent investors are in a pessimistic mood. The number of bullish hedge fund positions were cut by 2 recently. DAIO was in 4 hedge funds’ portfolios at the end of the third quarter of 2018. There were 6 hedge funds in our database with DAIO holdings at the end of the previous quarter. Not only that the stock is losing interest from already small number of hedge funds who were bullish on it in the previous quarter, it also doesn’t seem to get the attention from the richest investors in our database (if you are curious to see what stock are the most popular with billionaires check out the list of 30 stocks billionaires are crazy about: Insider Monkey billionaire stock index). Nevertheless, we are still interested in analyzing this stock further more.

In the eyes of most shareholders, hedge funds are perceived as slow, outdated financial vehicles of the past. While there are over 8000 funds trading at the moment, Our experts hone in on the aristocrats of this group, around 700 funds. It is estimated that this group of investors orchestrate the lion’s share of all hedge funds’ total asset base, and by tracking their top equity investments, Insider Monkey has identified several investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Trying to determine if Data I/O Corporation (NASDAQ:DAIO) is a good buy, we stumbled upon Long Cast Partners’ investor letter in which the fund discusses this stock, among others. Here is what Long Cast Partners said about the company:

“First of all, financial history indicates this is a very well managed company. CEO Anthony Ambrose took over in 2012, restructured, cut costs, invested in upgrading machines and focused the sales efforts on niche markets. The P&L under his tenure shows a slow steady progression of improving sales and BVPS while reducing (and holding) SG&A to below 30% and continued self-funding of R&D.

As a result of this focus, the company is growing share in the important automotive market. We are in an era of more devices with more chips and more information on these chips, particularly in automobiles. This has increased the need for electronics suppliers to the automotive industry to provide better, faster and more reliable for chip programming equipment. The upgrades have allowed Ambrose to put some distance between himself and its competitors.

Finally, there is an effort in the semi-conductor industry to secure chips using some of the same cryptographic tools used in securing communications (public and private keys, certificates, validation and other forms of authentication). The term for this is “Embedded Trust” or “Root of Trust”. The industry-wide issue is bringing the technology to market at scale and at a reasonable cost for consumer electronic adoption.

DAIO management is approaching this problem in a novel and fascinating way. Under the brand “SentriX” they are partnering with firms that offer security related IP, licensing the IP exclusively, packaging it as a platform (IP + their programmer) then giving (gratis, for free) the machine to the customer and charging a per unit price for a securely programmed chip, which they share with the IP provider. This solution solves problems and creates opportunities up and down the company’s ecosystem. I’ll note a few here.

- Direct customers like Avnet or Arrow or Bosch or Johnson Controls et al can offer a secure upsell with zero capital at

- Since DAIO is an essential gateway in the expansion of the IP, the IP partners are aligned with marketing a large footprint for these

- Getting more machines on more customer floors will put even more space between itself and its competitors. It appears to be the only programmer doing this at a scale at this

- The effort enables DAIO to transition from being a piece of equipment sold, to a platform that holds the keys (cryptographic and proverbial) towards an expanding To this point, it’s worth noting that one of the first IP partners, SecureThingz, was acquired by IAR Systems for $30M, on$500k of revenues. This indicates the perceived value in the technology.

- It would also enable DAIO to transition away from the cyclicality of capital goods spending towards more consistent and recurring This would offer visibility, which tends to justify a higher valuation multiples.

- The willingness to try something new and different reflects the quality of the grey matter managing the

In 2017, the company sold nearly two-years-worth of equipment in one. The headline “great year”followed by the 2018 negative comps lead the stock to “round trip”.

We have a more nuanced conclusion from that “great year” which we think has enduring benefits. In my view, it demonstrated the ability to articulate and successfully implement a focused strategy. Certainly, the outcome could have been completely random. But most importantly, during that growth year, the company managed its working capital with incredible acumen. That is not random and speaks to what we believe is an exceptionally high-quality executive team. Growth can kill. They thrived.

The company has a $40M mkt cap and nearly $20M in net cash. It manages a very conservative balance sheet. It continues to fund its own R&D. it trades at 9x annualized 2018 EBITDA, but if you normalized R&D, simply backing out the incremental investments in SentriX, it would be a 6x multiple. It just announced a $2M buyback, representing 5% of the outstanding shares. If SentriX works, we think in 3- 5 years this could be a substantially larger and different company. Meanwhile, we are paying a ho hum prices of what appears to be a very well run business that can still gain share in a fragmented industry. “

Continuing with our analysis, it’s time to review the new hedge fund action surrounding Data I/O Corporation (NASDAQ:DAIO).

How have hedgies been trading Data I/O Corporation (NASDAQ:DAIO)?

At the end of the third quarter, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of -33% from the second quarter of 2018. On the other hand, there were a total of 7 hedge funds with a bullish position in DAIO at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the largest position in Data I/O Corporation (NASDAQ:DAIO), worth close to $3.8 million, amounting to less than 0.1%% of its total 13F portfolio. The second largest stake is held by GLG Partners, managed by Noam Gottesman, which holds a $0.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish comprise Peter Muller’s PDT Partners, John Overdeck and David Siegel’s Two Sigma Advisors.

Because Data I/O Corporation (NASDAQ:DAIO) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there is a sect of funds that elected to cut their full holdings heading into Q3. Interestingly, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital sold off the biggest stake of the 700 funds watched by Insider Monkey, worth close to $0.1 million in stock. Chuck Royce’s fund, Royce & Associates, also sold off its stock, about $6,000 worth. These moves are important to note, as total hedge fund interest was cut by 2 funds heading into Q3.

Taking all this into account, including Long Cast Partners’ positive view on the company, we would still rather spend our time focusing on the stocks that hedge funds are piling on, like some from the list of 30 most popular stocks among hedge funds in Q3 of 2018.

Disclosure: None. This article was originally published at Insider Monkey.