At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

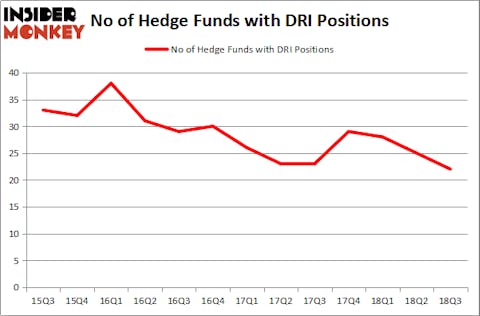

Is Darden Restaurants, Inc. (NYSE:DRI) the right pick for your portfolio? Prominent investors are reducing their bets on the stock. The number of long hedge fund bets were trimmed by 3 recently. Our calculations also showed that DRI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action surrounding Darden Restaurants, Inc. (NYSE:DRI).

How are hedge funds trading Darden Restaurants, Inc. (NYSE:DRI)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -12% from one quarter earlier. On the other hand, there were a total of 29 hedge funds with a bullish position in DRI at the beginning of this year. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

More specifically, AQR Capital Management was the largest shareholder of Darden Restaurants, Inc. (NYSE:DRI), with a stake worth $445.4 million reported as of the end of September. Trailing AQR Capital Management was Two Sigma Advisors, which amassed a stake valued at $160.2 million. Renaissance Technologies, D E Shaw, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because Darden Restaurants, Inc. (NYSE:DRI) has experienced a decline in interest from the smart money, we can see that there exists a select few funds who sold off their entire stakes by the end of the third quarter. Intriguingly, Louis Bacon’s Moore Global Investments sold off the largest investment of all the hedgies tracked by Insider Monkey, comprising an estimated $14.2 million in stock, and David Costen Haley’s HBK Investments was right behind this move, as the fund cut about $14 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Darden Restaurants, Inc. (NYSE:DRI) but similarly valued. We will take a look at Wynn Resorts, Limited (NASDAQ:WYNN), Fortis Inc. (NYSE:FTS), Teck Resources Ltd (NYSE:TECK), and Seagate Technology plc (NASDAQ:STX). This group of stocks’ market values are closest to DRI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WYNN | 43 | 2481578 | -1 |

| FTS | 14 | 230527 | 0 |

| TECK | 35 | 1102798 | 2 |

| STX | 27 | 1761695 | -2 |

| Average | 29.75 | 1394150 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $139 billion. That figure was $981 million in DRI’s case. Wynn Resorts, Limited (NASDAQ:WYNN) is the most popular stock in this table. On the other hand Fortis Inc. (NYSE:FTS) is the least popular one with only 14 bullish hedge fund positions. Darden Restaurants, Inc. (NYSE:DRI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard WYNN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.