Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about D.R. Horton, Inc. (NYSE:DHI).

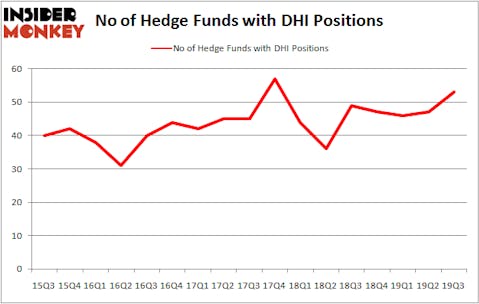

D.R. Horton, Inc. (NYSE:DHI) has experienced an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that DHI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a lot of gauges shareholders employ to size up stocks. Some of the less utilized gauges are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the elite money managers can trounce the market by a healthy margin (see the details here).

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the latest hedge fund action regarding D.R. Horton, Inc. (NYSE:DHI).

How are hedge funds trading D.R. Horton, Inc. (NYSE:DHI)?

Heading into the fourth quarter of 2019, a total of 53 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DHI over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Egerton Capital Limited was the largest shareholder of D.R. Horton, Inc. (NYSE:DHI), with a stake worth $494 million reported as of the end of September. Trailing Egerton Capital Limited was Long Pond Capital, which amassed a stake valued at $477.9 million. Greenhaven Associates, Lone Pine Capital, and Suvretta Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Long Pond Capital allocated the biggest weight to D.R. Horton, Inc. (NYSE:DHI), around 12.47% of its portfolio. Greenhaven Associates is also relatively very bullish on the stock, setting aside 8.9 percent of its 13F equity portfolio to DHI.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Capital Growth Management, managed by Ken Heebner, established the most valuable position in D.R. Horton, Inc. (NYSE:DHI). Capital Growth Management had $77 million invested in the company at the end of the quarter. Renaissance Technologies also made a $71.5 million investment in the stock during the quarter. The following funds were also among the new DHI investors: Josh Donfeld and David Rogers’s Castle Hook Partners, Principal Global Investors’s Columbus Circle Investors, and William Harnisch’s Peconic Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as D.R. Horton, Inc. (NYSE:DHI) but similarly valued. These stocks are ResMed Inc. (NYSE:RMD), Rockwell Automation Inc. (NYSE:ROK), ORIX Corporation (NYSE:IX), and Ameriprise Financial, Inc. (NYSE:AMP). This group of stocks’ market caps match DHI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RMD | 20 | 135795 | 10 |

| ROK | 26 | 468953 | -5 |

| IX | 4 | 7651 | -2 |

| AMP | 27 | 1104619 | -12 |

| Average | 19.25 | 429255 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $429 million. That figure was $2556 million in DHI’s case. Ameriprise Financial, Inc. (NYSE:AMP) is the most popular stock in this table. On the other hand ORIX Corporation (NYSE:IX) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks D.R. Horton, Inc. (NYSE:DHI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately DHI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on DHI were disappointed as the stock returned 5.3% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.