Insider Monkey finished processing more than 738 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of March 31st, 2019. In this article we are going to take a look at smart money sentiment towards Curtiss-Wright Corp. (NYSE:CW).

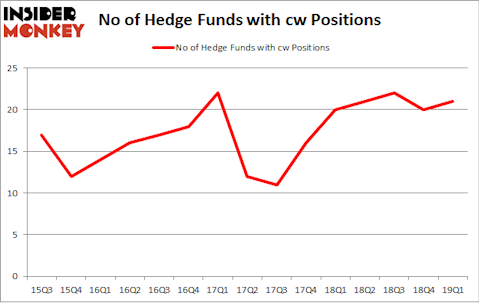

Is Curtiss-Wright Corp. (NYSE:CW) the right investment to pursue these days? Prominent investors are in a bullish mood. The number of long hedge fund positions improved by 1 in recent months. Our calculations also showed that cw isn’t among the 30 most popular stocks among hedge funds. CW was in 21 hedge funds’ portfolios at the end of the first quarter of 2019. There were 20 hedge funds in our database with CW holdings at the end of the previous quarter.

To most shareholders, hedge funds are viewed as unimportant, outdated financial tools of years past. While there are over 8000 funds with their doors open at present, Our researchers hone in on the masters of this club, approximately 750 funds. These hedge fund managers administer most of all hedge funds’ total asset base, and by following their unrivaled stock picks, Insider Monkey has deciphered many investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Noam Gottesman, GLG Partners

We’re going to view the recent hedge fund action regarding Curtiss-Wright Corp. (NYSE:CW).

How have hedgies been trading Curtiss-Wright Corp. (NYSE:CW)?

At the end of the first quarter, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the previous quarter. On the other hand, there were a total of 20 hedge funds with a bullish position in CW a year ago. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in Curtiss-Wright Corp. (NYSE:CW), which was worth $157.9 million at the end of the first quarter. On the second spot was GAMCO Investors which amassed $77.1 million worth of shares. Moreover, GLG Partners, Citadel Investment Group, and Millennium Management were also bullish on Curtiss-Wright Corp. (NYSE:CW), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names have jumped into Curtiss-Wright Corp. (NYSE:CW) headfirst. Gotham Asset Management, managed by Joel Greenblatt, assembled the largest position in Curtiss-Wright Corp. (NYSE:CW). Gotham Asset Management had $8.7 million invested in the company at the end of the quarter. Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital also initiated a $5 million position during the quarter. The other funds with brand new CW positions are Matthew Tewksbury’s Stevens Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s go over hedge fund activity in other stocks similar to Curtiss-Wright Corp. (NYSE:CW). We will take a look at Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR), NewMarket Corporation (NYSE:NEU), Highwoods Properties Inc (NYSE:HIW), and Entegris Inc (NASDAQ:ENTG). This group of stocks’ market caps are closest to CW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASR | 8 | 35587 | 3 |

| NEU | 21 | 88478 | 5 |

| HIW | 14 | 177459 | -3 |

| ENTG | 22 | 471301 | 4 |

| Average | 16.25 | 193206 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $193 million. That figure was $429 million in CW’s case. Entegris Inc (NASDAQ:ENTG) is the most popular stock in this table. On the other hand Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR) is the least popular one with only 8 bullish hedge fund positions. Curtiss-Wright Corp. (NYSE:CW) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CW, though not to the same extent, as the stock returned -0.1% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.