Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of Cumberland Pharmaceuticals, Inc. (NASDAQ:CPIX) based on that data.

Cumberland Pharmaceuticals, Inc. (NASDAQ:CPIX) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 3 hedge funds’ portfolios at the end of March. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Trevena Inc (NASDAQ:TRVN), Strattec Security Corp. (NASDAQ:STRT), and LMP Automotive Holdings, Inc. (NASDAQ:LMPX) to gather more data points. Our calculations also showed that CPIX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a large number of formulas stock traders employ to size up their holdings. Some of the best formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the best money managers can beat their index-focused peers by a superb margin (see the details here).

New York Stock Exchange

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, legendary investor Bill Miller told investors to sell 7 extremely popular recession stocks last month. So, we went through his list and recommended another stock with 100% upside potential instead. We interview hedge fund managers and ask them about their best ideas. You can watch our latest hedge fund manager interview here and find out the name of the large-cap healthcare stock that Sio Capital’s Michael Castor expects to double. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s view the key hedge fund action regarding Cumberland Pharmaceuticals, Inc. (NASDAQ:CPIX).

How are hedge funds trading Cumberland Pharmaceuticals, Inc. (NASDAQ:CPIX)?

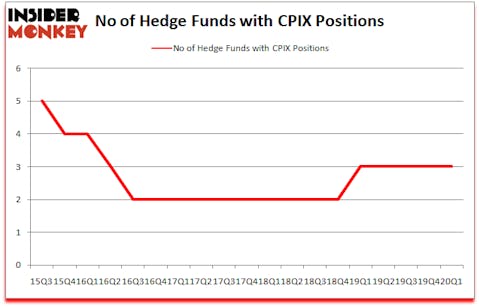

At the end of the first quarter, a total of 3 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards CPIX over the last 18 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Among these funds, Ariel Investments held the most valuable stake in Cumberland Pharmaceuticals, Inc. (NASDAQ:CPIX), which was worth $3.9 million at the end of the third quarter. On the second spot was Stonepine Capital which amassed $3.3 million worth of shares. Renaissance Technologies was also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Stonepine Capital allocated the biggest weight to Cumberland Pharmaceuticals, Inc. (NASDAQ:CPIX), around 3.48% of its 13F portfolio. Ariel Investments is also relatively very bullish on the stock, dishing out 0.07 percent of its 13F equity portfolio to CPIX.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Bailard Inc. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Stonepine Capital).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cumberland Pharmaceuticals, Inc. (NASDAQ:CPIX) but similarly valued. These stocks are Trevena Inc (NASDAQ:TRVN), Strattec Security Corp. (NASDAQ:STRT), LMP Automotive Holdings, Inc. (NASDAQ:LMPX), and Trevi Therapeutics, Inc. (NASDAQ:TRVI). This group of stocks’ market caps are closest to CPIX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRVN | 4 | 1874 | -1 |

| STRT | 4 | 9062 | 0 |

| LMPX | 1 | 292 | 0 |

| TRVI | 2 | 580 | -2 |

| Average | 2.75 | 2952 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 2.75 hedge funds with bullish positions and the average amount invested in these stocks was $3 million. That figure was $9 million in CPIX’s case. Trevena Inc (NASDAQ:TRVN) is the most popular stock in this table. On the other hand LMP Automotive Holdings, Inc. (NASDAQ:LMPX) is the least popular one with only 1 bullish hedge fund positions. Cumberland Pharmaceuticals, Inc. (NASDAQ:CPIX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd but beat the market by 15.6 percentage points. Unfortunately CPIX wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on CPIX were disappointed as the stock returned -2.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.