Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of CubeSmart (NYSE:CUBE).

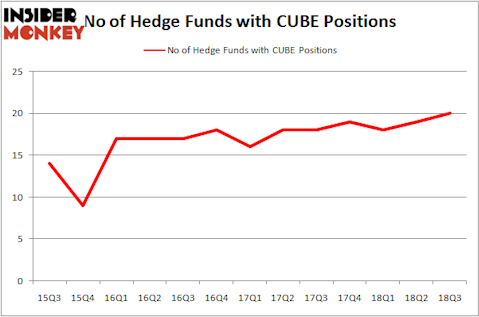

CubeSmart (NYSE:CUBE) investors should pay attention to an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that CUBE isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are many tools stock traders use to assess their holdings. Two of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the top money managers can outpace the market by a healthy margin (see the details here).

We’re going to take a gander at the new hedge fund action surrounding CubeSmart (NYSE:CUBE).

How have hedgies been trading CubeSmart (NYSE:CUBE)?

Heading into the fourth quarter of 2018, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. By comparison, 19 hedge funds held shares or bullish call options in CUBE heading into this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, Diamond Hill Capital held the most valuable stake in CubeSmart (NYSE:CUBE), which was worth $98.4 million at the end of the third quarter. On the second spot was AEW Capital Management which amassed $97 million worth of shares. Moreover, Millennium Management, Arrowstreet Capital, and Balyasny Asset Management were also bullish on CubeSmart (NYSE:CUBE), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names were leading the bulls’ herd. Snow Park Capital Partners, managed by Jeffrey Pierce, assembled the largest call position in CubeSmart (NYSE:CUBE). Snow Park Capital Partners had $4 million invested in the company at the end of the quarter. Louis Navellier’s Navellier & Associates also made a $2 million investment in the stock during the quarter. The only other fund with a new position in the stock is Frederick DiSanto’s Ancora Advisors.

Let’s go over hedge fund activity in other stocks similar to CubeSmart (NYSE:CUBE). These stocks are The Dun & Bradstreet Corporation (NYSE:DNB), H&R Block, Inc. (NYSE:HRB), Williams-Sonoma, Inc. (NYSE:WSM), and Exelixis, Inc. (NASDAQ:EXEL). This group of stocks’ market caps resemble CUBE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DNB | 34 | 792527 | 10 |

| HRB | 18 | 182945 | -2 |

| WSM | 23 | 560651 | 1 |

| EXEL | 23 | 679477 | -1 |

| Average | 24.5 | 553900 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $554 million. That figure was $448 million in CUBE’s case. The Dun & Bradstreet Corporation (NYSE:DNB) is the most popular stock in this table. On the other hand H&R Block, Inc. (NYSE:HRB) is the least popular one with only 18 bullish hedge fund positions. CubeSmart (NYSE:CUBE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DNB might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.