Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

CRA International, Inc. (NASDAQ:CRAI) has seen a decrease in support from the world’s most elite money managers recently. Our calculations also showed that crai isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Let’s analyze the recent hedge fund action regarding CRA International, Inc. (NASDAQ:CRAI).

Hedge fund activity in CRA International, Inc. (NASDAQ:CRAI)

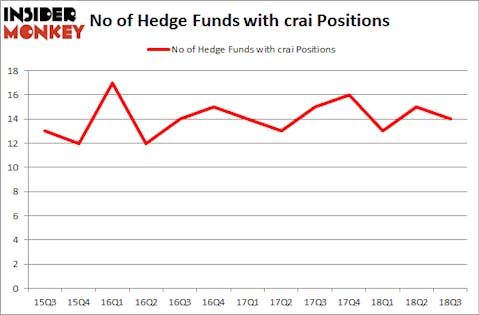

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CRAI over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in CRA International, Inc. (NASDAQ:CRAI) was held by Renaissance Technologies, which reported holding $27.7 million worth of stock at the end of September. It was followed by GLG Partners with a $9.4 million position. Other investors bullish on the company included AQR Capital Management, AlphaOne Capital Partners, and Arrowstreet Capital.

Seeing as CRA International, Inc. (NASDAQ:CRAI) has witnessed falling interest from hedge fund managers, logic holds that there lies a certain “tier” of hedge funds that decided to sell off their positions entirely heading into Q3. At the top of the heap, John H Lewis’s Osmium Partners dumped the biggest position of the “upper crust” of funds followed by Insider Monkey, worth an estimated $0.4 million in stock, and Matthew Hulsizer’s PEAK6 Capital Management was right behind this move, as the fund dropped about $0.2 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 1 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to CRA International, Inc. (NASDAQ:CRAI). We will take a look at Marinus Pharmaceuticals Inc (NASDAQ:MRNS), MidWestOne Financial Group, Inc. (NASDAQ:MOFG), RBB Bancorp (NASDAQ:RBB), and Royce Micro-Cap Trust, Inc. (NYSE:RMT). This group of stocks’ market valuations are closest to CRAI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MRNS | 13 | 82923 | 4 |

| MOFG | 5 | 35948 | -1 |

| RBB | 5 | 7234 | 1 |

| RMT | 4 | 25989 | 1 |

| Average | 6.75 | 38024 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $38 million. That figure was $68 million in CRAI’s case. Marinus Pharmaceuticals Inc (NASDAQ:MRNS) is the most popular stock in this table. On the other hand Royce Micro-Cap Trust, Inc. (NYSE:RMT) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks CRA International, Inc. (NASDAQ:CRAI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.