It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2018) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Core-Mark Holding Company, Inc. (NASDAQ:CORE).

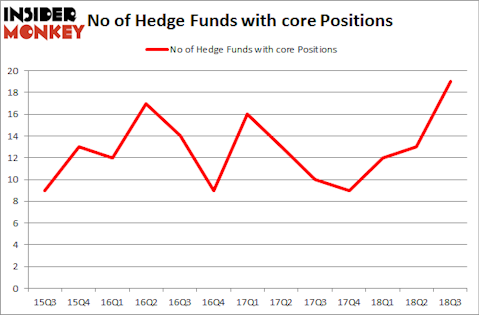

Is Core-Mark Holding Company, Inc. (NASDAQ:CORE) a buy right now? Money managers are buying. The number of bullish hedge fund positions rose by 6 in recent months. Our calculations also showed that core isn’t among the 30 most popular stocks among hedge funds.

At the moment there are tons of indicators investors employ to size up their stock investments. Some of the most underrated indicators are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the elite money managers can outperform their index-focused peers by a superb margin (see the details here).

Let’s view the new hedge fund action regarding Core-Mark Holding Company, Inc. (NASDAQ:CORE).

How are hedge funds trading Core-Mark Holding Company, Inc. (NASDAQ:CORE)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 46% from the previous quarter. On the other hand, there were a total of 9 hedge funds with a bullish position in CORE at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Royce & Associates was the largest shareholder of Core-Mark Holding Company, Inc. (NASDAQ:CORE), with a stake worth $28.9 million reported as of the end of September. Trailing Royce & Associates was Millennium Management, which amassed a stake valued at $20.3 million. GLG Partners, Renaissance Technologies, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, some big names were leading the bulls’ herd. GLG Partners, managed by Noam Gottesman, established the biggest position in Core-Mark Holding Company, Inc. (NASDAQ:CORE). GLG Partners had $9 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $4.3 million position during the quarter. The other funds with new positions in the stock are Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, Paul Tudor Jones’s Tudor Investment Corp, and Brandon Haley’s Holocene Advisors.

Let’s go over hedge fund activity in other stocks similar to Core-Mark Holding Company, Inc. (NASDAQ:CORE). We will take a look at GameStop Corp. (NYSE:GME), Insmed Incorporated (NASDAQ:INSM), Rush Enterprises, Inc. (NASDAQ:RUSHB), and Sonic Corporation (NASDAQ:SONC). This group of stocks’ market caps resemble CORE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GME | 20 | 118701 | -3 |

| INSM | 17 | 310696 | -3 |

| RUSHB | 5 | 36169 | 1 |

| SONC | 20 | 99389 | 7 |

| Average | 15.5 | 141239 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $141 million. That figure was $89 million in CORE’s case. GameStop Corp. (NYSE:GME) is the most popular stock in this table. On the other hand Rush Enterprises, Inc. (NASDAQ:RUSHB) is the least popular one with only 5 bullish hedge fund positions. Core-Mark Holding Company, Inc. (NASDAQ:CORE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GME might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.